When a “new” future emerges it takes time before useful and accurate correlations come into focus. Such is the case with Carbon Emissions but maybe, we’re finally starting to see one. Remember Carbon Emissions are denominated in Euros. Like trade correlations in the Dollar denominated futures contracts, when the Dollar goes up quite often the correlated future goes down. It appears that is beginning to happen with respect to the Euro and Carbon Emissions; the Euro is weakening and Carbon Emissions are heading higher.

Please note that even the best, most reliable of correlations fail on a day-to-day basis. The Dollar is trading higher today; so is crude oil. Normally when the Dollar is higher crude is lower. But don’t worry, another correlation is functioning as as expected; the Dollar is higher and Soybeans are trading lower. Quite often correlations take a back seat to other underlying macroeconomic fundamentals and geopolitical nuances in the market. There’s a lot to be aware of; no one can take it all in but it’s important to keep your eyes and especially your ears open.

Don’t ever bank on this “new correlation” other than watching this new relationship to see if it continues to develop. Remember, it’s the “woke” world that’s buying these new Carbon Emission contracts. It’s “voluntary” at the present time and is not going to be “required” for a couple more years, at least that’s the current plan. So if you own a “forest” you can sell these “credits” and create a new cash flow you couldn’t do prior. When it changes to being a “required” thing to purchase for some egregious polluters, that equation is going to change diametrically and the demand should cause Carbon Emission contracts to soar. For now however it’s just a “number” but perhaps there is a standard correlation beginning to come into focus with the Euro. Time will tell.

Carbon Emissions

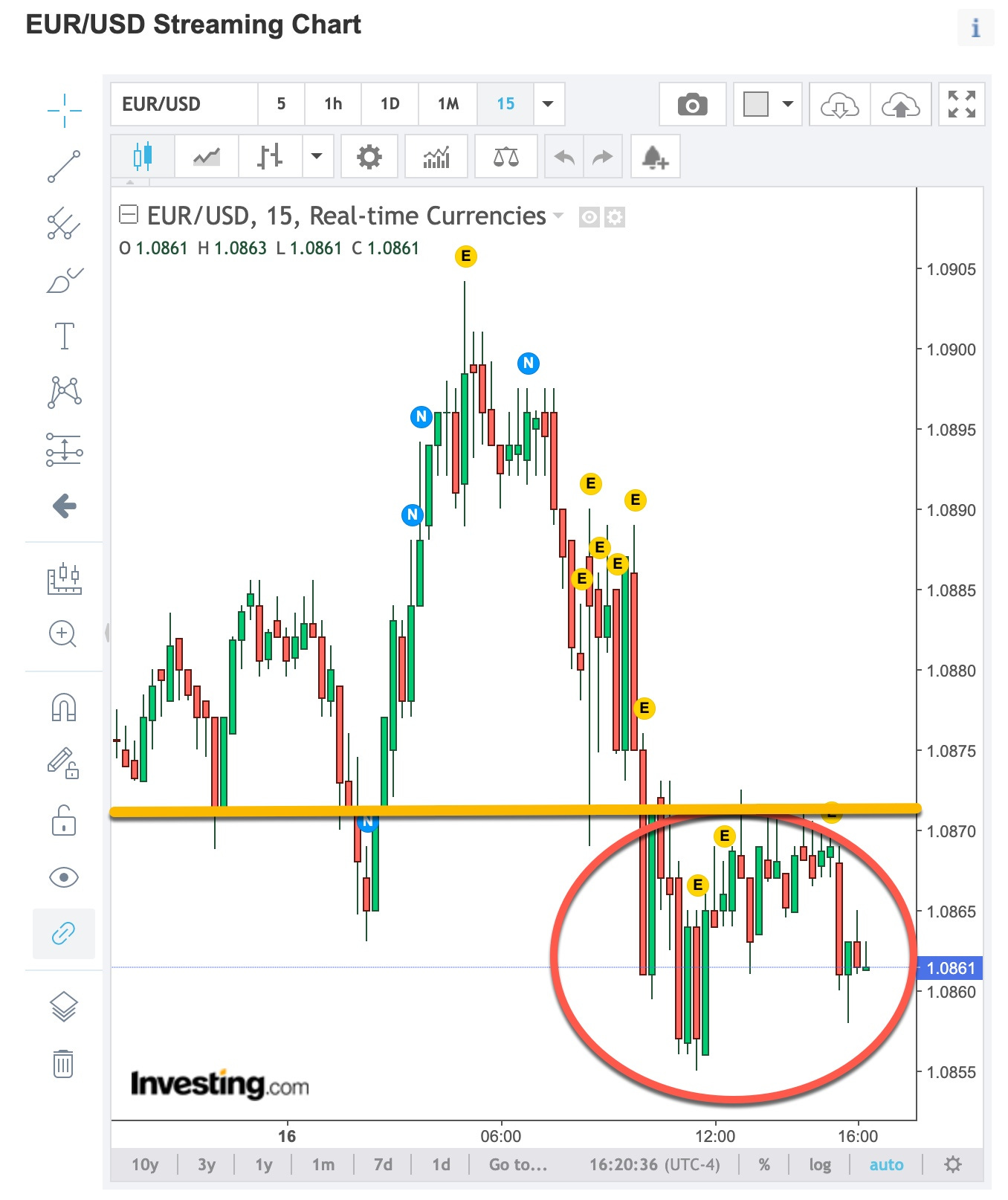

EUR / USD

Now back to the issue that’s driving today’s stagnating markets. Folks, what’s going on before your eyes with the debt crisis is a “lose-lose” proposition. In other words, the solution to the debt crisis is worse than the solution. Naturally, if they are unable to “raise the debt limit” markets are more than likely going to crater. There are more than enough articles out there floating around and many better written than I care to compete with so click on your favorite AI source and read away.

But what happens if they raise the debt limit? The effect on the markets, while maybe not as negatively severe, are not going to be much better. Think about it, if they raise the debt limit who do you think is going to be first in line to borrow money? The good old U.S, Treasury; they have bills to pay and more political “pork” to spend it on than ever before. Will we ever learn?

So whatever liquidity that remains in this money supply dwindling economy is going to get sucked up by Uncle Sam. Rates will immediately increase, competition for what little liquidity that remains, like any commodity, when demand outstrips supply the price goes up. This actually might make the Fed happy; rates up, corporate profits decrease, more people get laid off and unemployment finally rises. That’s exactly what they are looking for right? They’re about to get their wish as there’s not a “snowball’s chance in hell” that they’re not going to raise the debt limit and let the U.S, default.

So there you have it, a “lose-lose” scenario and something I’ve been looking for; a chance to buy equities at a discount, even some Biotechs. Sorry for my delay on getting that analysis published. I’ve been busy and with what’s on my plate building The Ticker EDU and I’m going to stay busy. It’s all your fault but don’t worry, thanks. In any case there’s still some time before I’d pull the trigger on the Biotechs so sit back and wait and thanks for adopting The Ticker EDU; I’ll make it worth your while. Is there anyone out there who can figure out how to put a couple extra hours into each day? Believe me, I’d be happy to pay for that.

Today’s market action brings another philosophy into focus that traders, more so than investors, keep an eye on especially when markets are trading in tight channels. Being in tight channels often trigger “over bought” and “over sold” signals. Yesterday there was rhetoric from the “powers that be” that the markets, the indices you often trade, were over sold. The result, today’s rally. Will it continue, no one knows? Markets are alive, they have a heartbeat. That’s why, when I first published what i write, the name chosen for my dissertations was “The Ticker”. It fit then and more than 40+ years later it still fits today.

There is no easy pathway to making “easy” money, not here in learning how to invest or trade or anywhere else in life. Respect how difficult it is to invest or trade in these markets, put the time in and I bet you'll do just fine; it’s a marathon, not a sprint and practicing every day is a pathway to becoming the best damn investor or trader you can be.

Hope you enjoyed this post. I’m just a young 68 years old; my Dad became a broker when I was 13. It’s time for me to ‘give back’ to all of you what’s in my head. It’s not always pretty but it’s based on history . . . and history, unchecked, repeats itself.

Everyone learns at their own pace. If you pick everything up the first time through, great but if not email me at david@thetickeredu.com so we can further help. Thanks again go out to Danny www.mrtopstep.com . . . check him out; he’s worth your “click” and thanks to all of you who have adopted what is being created and presented; we’re humbled by the response and referrals. Again, let me know what you want to learn, I’m all ears.

“Time Is On My Side” . . . we ain’t hit the bottom yet . . . but like always, with our own failures . . . we’ll get there.