The markets hate uncertainty. I love it as “out of chaos comes calm.” It’s true, one just needs to understand that timing is everything. That’s why I look for good stocks that are having a “bad” time. I look for novel opportunities as well.

The Bigger They Are

Regeneron Pharmaceuticals (“REGN’) is a leading American biotechnology company headquartered in Tarrytown, New York. Founded in 1988 by Leonard Schleifer and George Yancopoulos. It focuses on inventing, developing, and commercializing life-transforming medicines for people with serious diseases. Regeneron is renowned for its strong in-house research capabilities and its commitment to translating scientific discoveries into effective medicines.

Regeneron's success is underpinned by its proprietary technology platforms, notably the VelociSuite®, which includes VelocImmune® and VelociMab®. These platforms enable the rapid development of fully human monoclonal antibodies and have been instrumental in advancing the company's diverse pipeline of therapeutics.

Regeneron has developed several FDA-approved therapies across various therapeutic areas:

Eylea® (aflibercept): A treatment for wet age-related macular degeneration and other retinal diseases. I’m part of their high-dose study through Austin Retina.

Dupixent® (dupilumab): Developed in collaboration with Sanofi, this drug treats conditions like atopic dermatitis, asthma, and chronic rhinosinusitis with nasal polyposis.

Libtayo® (cemiplimab): An immunotherapy for certain types of skin and lung cancers.

Praluent® (alirocumab): Also in partnership with Sanofi, this medication lowers LDL cholesterol levels.

Evkeeza® (evinacumab): A modern-day treatment for homozygous familial hypercholesterolemia, a rare genetic disorder.

Regeneron invests heavily in research and development, focusing on areas such as oncology, immunology, and genetic diseases. It employs advanced technologies to discover and develop new therapeutics, gene therapies, and bispecific antibodies.

As of 2024, Regeneron reported revenues of $14.2 billion, with a net income of $4.413 billion. It has a robust financial position, with assets totaling $37.76 billion and equity of $29.35 billion.

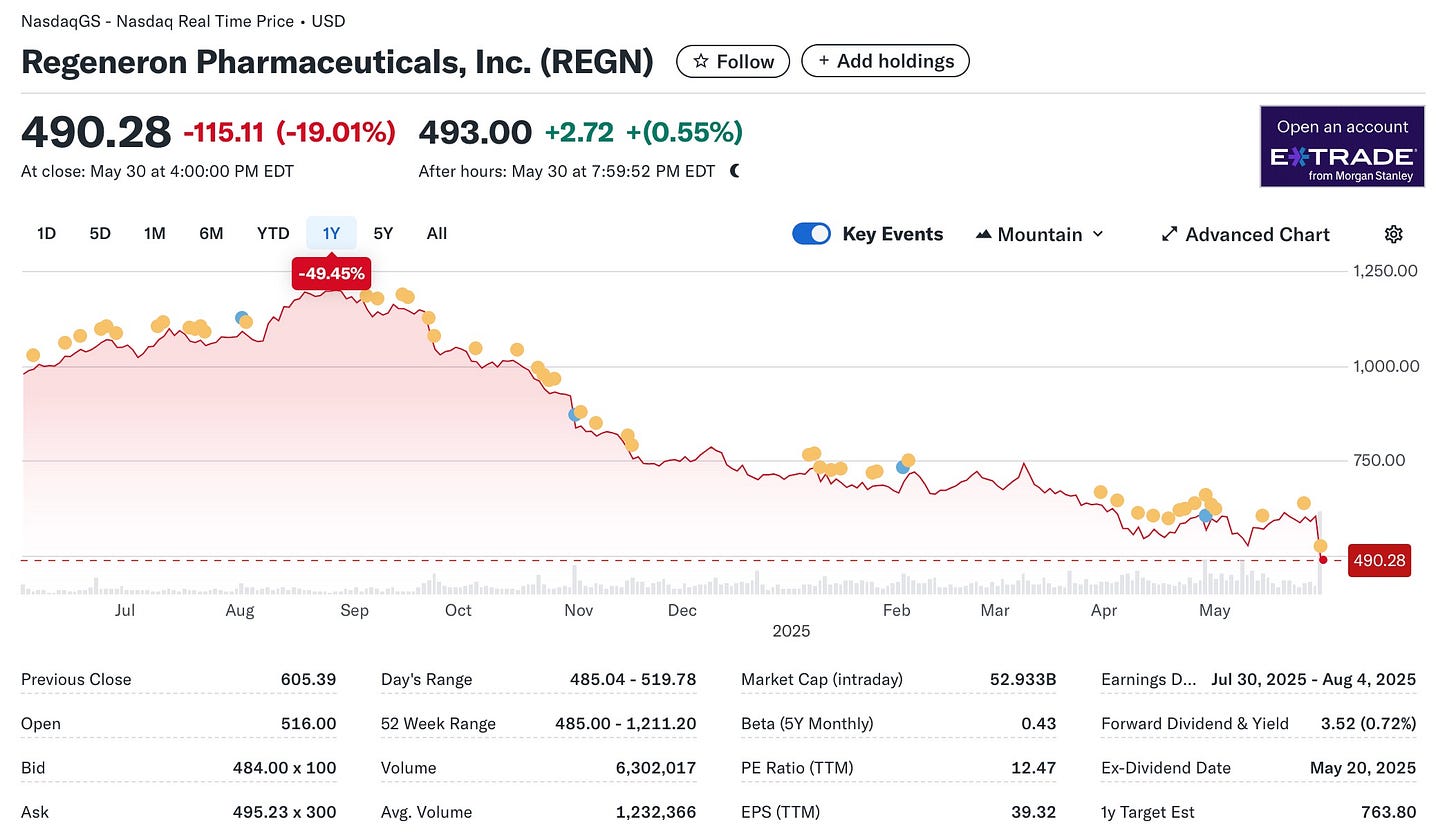

Stock Performance: On May 30, 2025, Regeneron's stock declined by 19% to $490.28 following mixed results from two Phase 3 trials of itepekimab, a COPD treatment developed with Sanofi.

Acquisition of 23andMe: Regeneron announced plans to acquire genetics company 23andMe for $256 million, aiming to enhance its genetic research capabilities.

Gene Therapy Advancements: The company reported positive results from a gene therapy study aimed at improving hearing in children with congenital deafness, marking a significant step in its gene therapy endeavors.

Regeneron continues to be a prominent player in the biotechnology industry, driven by its commitment to scientific innovation and the development of therapies that address unmet medical needs.

I’m a buyer at this level. You should be, too.

Indecision Equals Decision

UnitedHealth Group Incorporated (“UNH”) is a leading American multinational healthcare and insurance company headquartered in Eden Prairie, Minnesota. It was established in 1977 and operates through two primary businesses: UnitedHealthcare, which offers health insurance, and Optum, which provides healthcare services, data analytics, and pharmacy care. As of 2024, UnitedHealth Group served approximately 148 million individuals worldwide.

UnitedHealthcare: This division delivers a range of health benefit plans and services across four key areas:

Employer & Individual: Offers health coverage to large national employers and individuals.

Medicare & Retirement: Provides health and well-being services to individuals aged 65 and older.

Community & State: Serves state programs catering to economically disadvantaged and medically underserved populations.

Global: Delivers healthcare and benefits services to approximately 2.2 million people in South America.

Optum: Established in 2011, Optum integrates technology, data, and clinical expertise to enhance healthcare delivery. It comprises three main units:

OptumHealth: Provides primary and secondary care services.

OptumInsight: Offers data analytics, technology, and operational services.

OptumRx: Delivers pharmacy care services.

In 2024, UnitedHealth Group reported:

Revenue: $400.3 billion, an 8% increase year-over-year.

Net Income: $14.4 billion, a decline attributed to rising medical costs and the impact of a significant cyberattack.

The company adjusted its 2025 earnings outlook, projecting adjusted net earnings between $26.00 and $26.50 per share, down from the previous estimate of $29.50 to $30.00.

UnitedHealth Group has faced several significant challenges:

Cybersecurity Incident: In February 2024, a cyberattack on its subsidiary, Change Healthcare, disrupted electronic payments and medical claims processing, leading to widespread operational issues.

Leadership Changes: Following the tragic death of UnitedHealthcare CEO Brian Thompson in December 2024 and subsequent executive transitions, Stephen J. Hemsley returned as CEO in May 2025.

Financial Pressures: The company has been grappling with increased medical costs, particularly in its Medicare Advantage segment, leading to a significant drop in stock value and investor concerns.

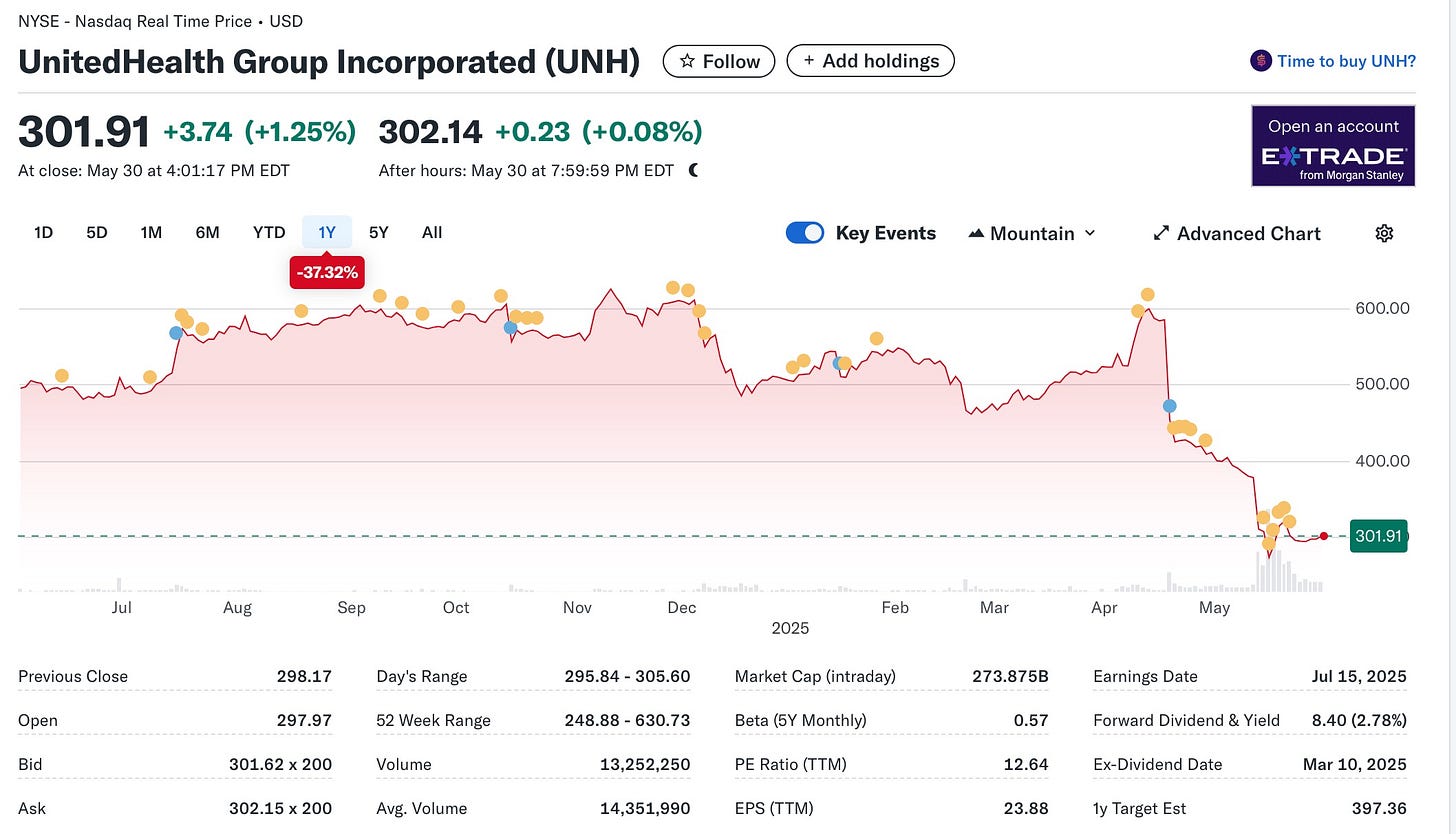

As of May 31, 2025, UnitedHealth Group's stock (NYSE: UNH) is trading at $301.91, reflecting a decrease of about 50% from its highs. The stock has experienced volatility due to recent operational and financial challenges.

I’ve been in and, luckily, out of this one recently, but insider action on the “buy side” is on the rise, so it’s back on the radar.

Trade Creates Opportunity

China is an enemy, not a friend. Keep that in mind as you watch Trump in action. It does not take a “rocket scientist” to understand that the Gulf of America offers many opportunities, especially those geared towards the rare earth element side. The whole world is watching. We’re taking action.

Do you remember back to 1968 when protesting in these United States actually had some real meaning? I didn’t think so, but the Chicago Transit Authority did. It was a time when young people told a story that made sense. No one wanted to serve in a war that we were losing. No one wanted to be drafted. Made sense to me and served as a good reason for my participation. Buying low and selling high makes sense, too, but it is equally important to be patient and pick your long-term opportunities carefully.