It never fails. The “powers that be” create a problem then exacerbate it further with solutions that “fuel the fire” creating additional problems. There should be a law that prevents this perpetual decision-making. After all, you can backtest your trading and investment strategies; certainly there must be a way for our beloved Federal Reserve, Congress and Executive administration to do the same thing, right? My fear is that is exactly what they’ve been doing. I guess there’s a problem with their data, eh? Kamala must be compiling it as she handles “AI”; you know it’s just “two letters”.

Four times in my career I’ve suggested buying bonds. Sure, I love to speculate like the rest of you but conservative certainty is where increases in net worth emerge. It’s time to buy bonds. Can you think of a better investment where you can (1) preserve capital; (2) earn current income; and (3) potentially achieve capital appreciation? Observations suggest we’re back in the early 1980s; Voelker realized it was time to reduce rates and intermediate to long term bond prices soared. We’re back.

Most of the world seems content to currently hold rates steady to the exception of UK and the US and I’m not sure of what the Fed’s next moves will be. Regardless we are getting closer to joining that crowd. It’s what happens next that sets the stage for the next move; (1) an inverted yield curve returning to a more normal distribution and (2) the Fed beginning to lower rates. The street suggests that is going to happen sooner than later. I agree and so does one of the best fixed income trader I follow, J.P. Morgan Asset Management’s chief investment officer Bob Michele. He’s been waiting like me and like me is ready to pull the trigger. As a matter of fact, he’s started.

Talk On The Street

Bob Michele’s been gearing up for a bond rally since late last year. If you take a closer look at JPM’s earnings you’ll see that he’s been buying government bonds as they fell to multi-year lows. He believes the US economy will enter a recession as the Federal Reserve went too far in raising interest rates. When that “infamous” recession finally hits is anyone’s guess. Nonetheless, this is one trade you want to “be in early”. Street talk and metrics suggest the Fed is once again behind the curve. Get in front of them and start buying bonds; as noted prior, I’m usually right about major market changes albeit sometimes a little early. Always do your own due diligence but don’t wait too long to act this time.

When Michele saw that inflation in US cooled more than economists had forecast, he acted. Noting that a deeply inverted US yield curve spells trouble, he believes that the Fed will be forced to cut rates possibly by the end of this year. I’m not sure when that’s going to happen but take into consideration that Michele’s long duration position is now the biggest since the start of the pandemic. The more than four decade pro was on the right pathway then and is right again.

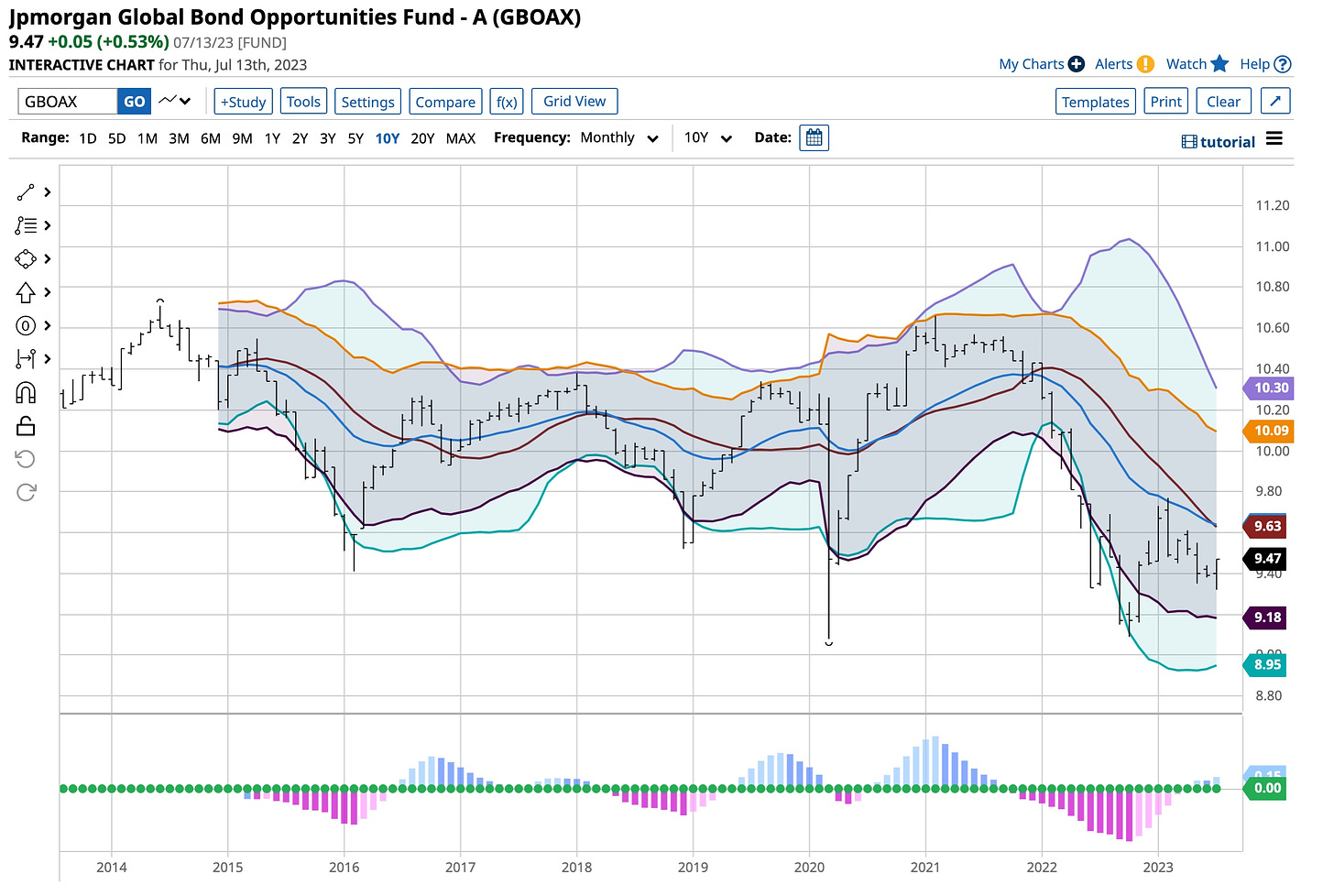

Michele’s JPMorgan Global Bond Opportunities Fund gained 2% this year, lagging almost 70% of its peers. His longer-term track record is encouraging, outperforming 95% of its peers over the past three years and 97% in five years. Not too shabby, eh?

Michele “goes both ways”. Like me, in October 2021, when most economists expected the Fed to hold rates near zero he said the central bank was way behind the curve and would need to aggressively fight inflation. Today he’s been quoted saying “it’s hard to be upbeat about the economy”. A recent Fed report showed 37% of US companies are in distress, more than during most tightening episodes since the 1970s. My favorite Einstein quote sums up what’s transpiring here best:

“Great spirits have always encountered violent opposition from mediocre minds. The mediocre mind is incapable of understanding the man who refuses to bow blindly to conventional prejudices and chooses instead to express his opinions courageously and honestly.”

“Based on all the stress we’re seeing in the system, we’re pretty confident we’re going to see that sharp rise in unemployment,” said Michele. “It’s going to feel like a soft landing until you actually hit recession.” Great minds think alike; he just gets paid a little more than I do to prognosticate. That’s OK; it’s good to be right.

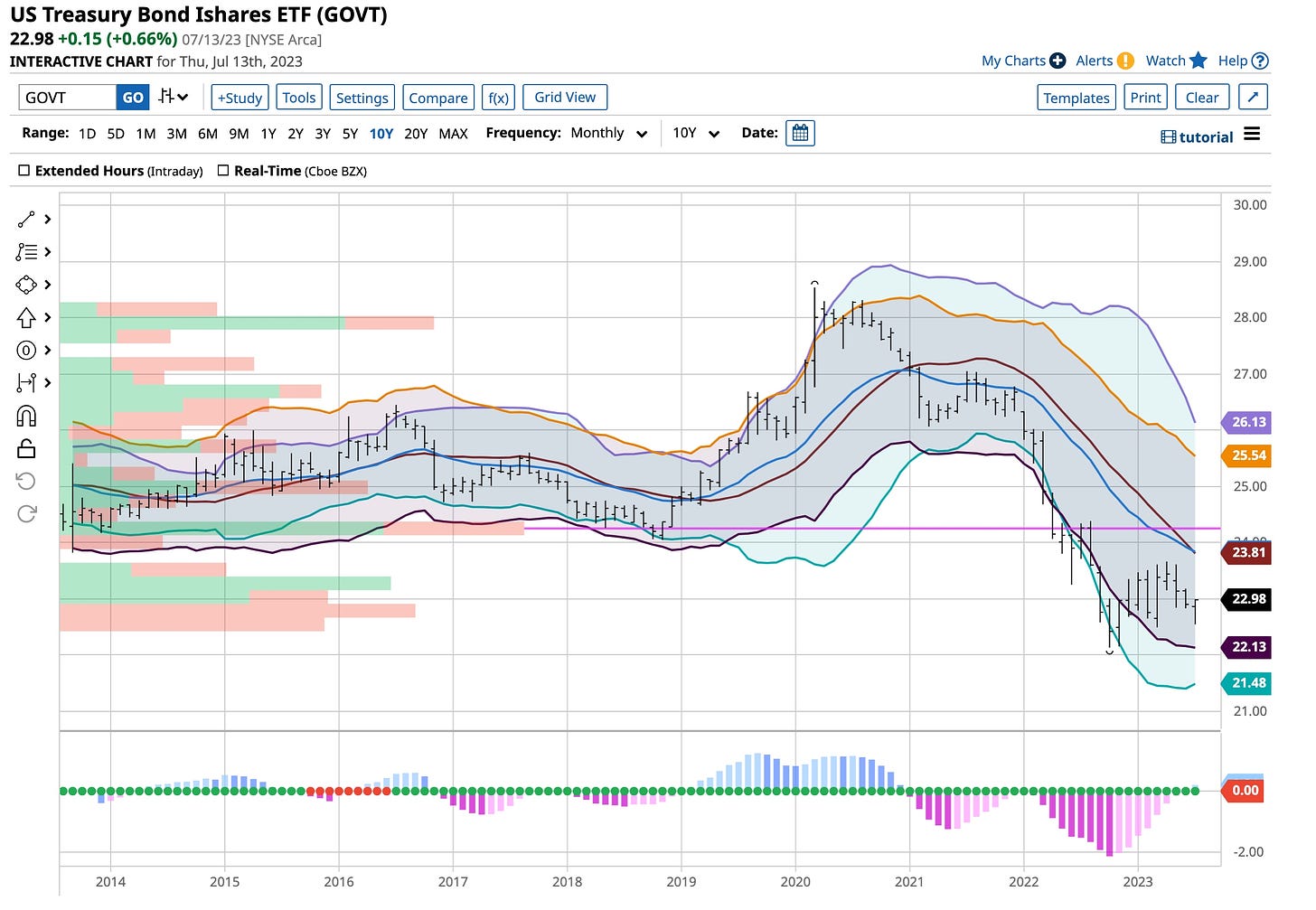

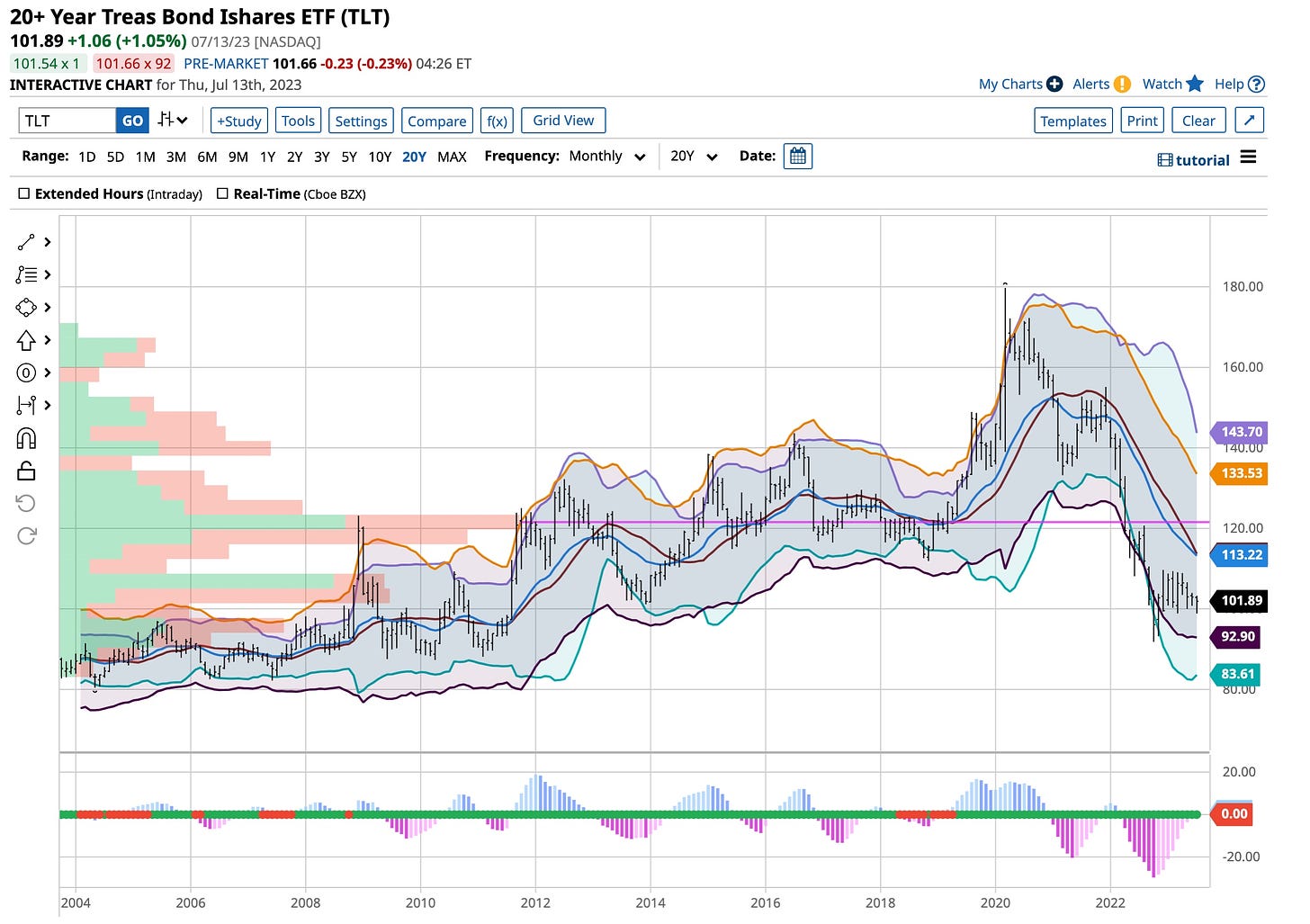

In addition to JPMorgan’s Global Bond Opportunities Fund the following ETFs will more than satisfy the investment objectives discussed above. There are many ETFs to choose from; I have a tendency to stick with the largest, best managed ones but again, the choice is yours. Go buy GOVT & TLT and hold them for a while in your portfolio.

US Treasury Bond Ishares ETF - GOVT

I hope you enjoy the charts posted from Barchart. Give Barchart a try, just “click here”; get a trial for free at no risk. It just might be the best ‘click’ you’ve ever made.

20+ Treas Bond Ishares ETF - TLT

Buttressed by Bloomberg

I’m not interested in “stealing another’s steam” but realize that copying and posting a link from Bloomberg doesn’t always do the trick unless you have an account. So what follows is an excerpt of exactly what was on my “notifications” this morning so you’ll see that great minds do think and work alike, especially those with experience.

By Ye Xie, and Liz Capo McCormick

July 15, 2023 at 4:00 PM EDT

Investors loading up on long-term bonds have history at their back.

For decades, Treasuries maturing in 10 or more years have consistently outperformed shorter-dated sectors immediately following the last in a series of rate increases by the Fed. On average, they returned 10% over six months after the fed funds rate peaked.

Of course, only in hindsight is it known whether a rate increase is the last one. But investors have embraced the view that an expected quarter-point hike in the target range for the federal funds rate on July 26 will conclude the epic series that began in March 2022. And surveys by Bank of America Corp. and JPMorgan Chase & Co. have found that investors digesting the price action have jacked up their exposure to long-dated bonds.

“We like the idea of extending and adding duration at this point in the cycle,” said Nisha Patel, a managing director of SMA portfolio management at Parametric Portfolio Associates LLC. “Historically, over previous tightening cycles, yields have tended to decline” during the period between the last hike and the first rate cut, she said.

Bonds this week logged their biggest gains since March — when the failure of several regional banks unleashed haven demand — after a report showed CPI increased at the slowest pace in two years. Swap contracts that as recently as last week assigned more than 50% odds to another Fed rate increase after this month repriced that to around 20%, and added to wagers on rate cuts next year.

The sentiment shift kneecapped the dollar, which suffered its biggest weekly loss since November. With the European Central Bank and other major monetary authorities expected to remain in tightening mode, there’s probably more downside in store for the greenback, according to strategists at ING Bank N.V.

In bonds, the biggest moves in yield were in short- and intermediate-maturity tenors where expectations for Fed policy are expressed. The five-year rate tumbled nearly 35 basis points, compared with just 13 basis points for the 30-year.

But long-dated bonds’ greater price sensitivity to a given change in yield means investors can reap bigger rewards. On average, Treasuries maturing in 10 or more years have gained 10% in the six months after a Fed policy-rate peak, compared with 6.5% for bonds maturing between five and seven years and 3.7% for those due within three years, according to data compiled by Bloomberg. In 12 months, the longest-dated bonds returned 13%, outpacing the other sectors.

“There is finally income to be earned in the fixed-income market,” BlackRock President Rob Kapito told analysts Friday, calling the higher yields a “remarkable shift” and a “once-in-a-generation opportunity.”

As an end-of-cycle theme, it’s proven more reliable than wagering on relative changes in yields such as the one that occurred this week as two- to five-year rates dropped more than longer-dated ones, producing a steeper yield curve.

The difference between two- and 10-year yields increased in the six months after the Fed concluded a tightening cycle in December 2018, but it narrowed following the end of one in 2006.

“Going long duration at the end of the hiking cycle is a more consistent trade than the steepener, which is more conditional on a harder landing outcome from the Fed,” Bank of America’s strategists including Mark Cabana and Meghan Swiber wrote in a note.

A Bank of America investor survey conducted monthly since 2004 found that respondents had amassed a record amount of interest-rate risk relative to their benchmarks in June before trimming a bit this month.

“I love duration here,” said Eddy Vataru, a fixed-income manager at Osterweis Capital Management. Inflation, which cooled to 3% last month, its 12th straight drop from a peak of 9.1% last year, has scope to fall below 2%, he said.

To be sure, Fed policymakers remain on guard. Their quarterly forecasts for the policy rate released in June had a median expectation for two additional increases this year. Fed Governor Christopher Waller Thursday said he agreed with that even after the latest inflation reading as the labor market remains very robust.

Even if employment strength induces the Fed to keep tightening beyond July, investors may pile into Treasuries because yields are high enough to be a compelling hedge against a possible recession, said Michael Franzese, head of fixed-income trading for New York-based market-maker MCAP LLC.

“You have a lot of investors looking now to make a bet and buy” if yields move back up, he said. “We may see a wave of new buying coming in, as Treasuries are an asset that could start to accrete really well for investors when the Fed does eventually start cutting.”

From Bloomberg - What to Watch

Economic data calendar

July 17: Empire manufacturing

July 18: Retail sales; New York Fed services business activity; industrial production; business inventories; NAHB housing market index; Treasury International Capital flows

July 19: MBA mortgage applications; housing starts

July 20: Weekly jobless claims; Philadelphia Fed business outlook; existing home sales; leading index

July 17: Empire manufacturing

July 18: Retail sales; New York Fed services business activity; industrial production; business inventories; NAHB housing market index; Treasury International Capital flows

July 19: MBA mortgage applications; housing starts

July 20: Weekly jobless claims; Philadelphia Fed business outlook; existing home sales; leading index

No Federal Reserve speakers slated during self-imposed quiet period ahead of July 26 rate decision

Treasury auction calendar:

July 17: 13-week and 26-week bills

July 18: 42-day cash management bill

July 19: 17-week bills, 20-year bond reopening

July 20: 4-week and 8-week bills, 10-year Treasury Inflation Protected Securities

July 17: 13-week and 26-week bills

July 18: 42-day cash management bill

July 19: 17-week bills, 20-year bond reopening

July 20: 4-week and 8-week bills, 10-year Treasury Inflation Protected Securities

Thanks Bloomberg, although I don’t agree with everything you print there are times like these when I just have to “tip my hat”. I’d still be watching earnings like a hawk but keep in mind, “the street” has a way of lowering estimates so their final numbers get beat. Listen to what expectations and forward statements are in addition to what’s reported.

Damn it’s hot down here in Texas. I’m still busy drafting courses, pretty much around the clock taking what’s “in my head” to put it “between your ears”. Udemy is going to be the “mechanism” used to deliver these courses. Hopefully I’ll start testing a few by the end of the month. I’m getting pretty good on these “newfangled editors” and with this sunny weather my tan is shaping up, eh?

Together with Substack, I’m putting together a method to receive payment for what I post. Hopefully you’ve found my words and thoughts beneficial. I do learn something new every day and hope you do as well. I’m not switching to a “Paid” Substack model at this time so don’t worry. There’s too much that needs to be addressed, learned and practiced but starting soon I’ll have a link where “founder contributions” can be made but in the interim just enjoy and please refer your friends . . . and thanks.

I’m just a “young” 68 years old looking to help you become the best damn investor or trader you can possibly be. Everyone learns at their own pace. If you pick everything up the first time through, great but if not email me at david@thetickeredu.com so we can further help. Again, let me know what you want to learn, I’m all ears.

Did you see “Oppenheimer” yet? We’re talking about Albert Einstein here so I felt it appropriate to post the trailer. Hollywood is “closed for business”. From my anti-woke perspective I couldn’t be happier. Between all of the rhetoric, policy decisions and the “fake news” that proliferates the airwaves we don’t need Hollywood. Just because you have made a bunch of money doesn’t mean the world should listen to what you have to say. Everyone is more than welcome to openly “state your opinion”; this is still a “free country”. I just wish we could “Make Orwell Fiction Again”.