Bob Dylan said and sang it better than anyone I know way back in the 1960s when he came out with “The Times They Are A-Changing”. They are and this week there were plenty of changes brought to you by earnings reports and statements about the future.

If you are following me on LinkedIn you would know that I bought short term puts on Disney and PayPal. Both worked but for different reasons. Here’s what I did, actions I took subsequently and where I stand today. You see folks, just like I scream at you on a daily basis, I follow my own rules. You should too but I realize, it takes time to learn and that’s why I’ll “hopefully” introduce the start of “The Ticker’s Udemy” campaign where we’ll teach you the “beginning” of what we’ve delivered in “The Ticker’s Bible”. It’s a start and like anything else that’s good, it takes time. Thanks for giving me that time. Now let’s look at a few of the “changes” that came into focus yesterday and the reactions I made to the news.

Bye Bye PayPal

What can I say. I ran the stock making a 3X bagger beginning when the world was in complete asunder at the start of COVID-19 in early 2020. Face it, the world turned to PayPal to handle their monetary transactions as well as it being a great place to start to buy, and eventually sell Bitcoin. Like Dylan said, times then were a changing and it is apparent that they did again yesterday.

While PayPal beat it’s “numbers” what they said about the future left a hole in hearts who love the company. Consider me one, it is my belief that PYPL will come back but that’s not going to happen anytime soon. So what did I do?

Before PYPL announced earnings I bought short term puts to protect my position if it indeed declined. I was on the conference call and without question, the tenor was not to my liking so I sold my entire position as the call was starting, booking about 10% to the upside. Lucky me, I held on to the short term puts, all of which I sold today when I sold short 2024 PYPL 50’s puts going out seven to ten months. Selling 55 puts was the way I picked up most of my PYPL this time so I thought it best to scale it a bit lower.

So I made money on the short term puts, literally I more than doubled the risk I took and now I’m short the 50s hoping for the company’s stock to head lower so I can pull off the same trick as I did before. Again, I like the company but it is obvious that the competition surrounding what they do will hurt gross margins in the short run. Time will tell so stay tuned and remember, things change so keep your eyes and ears open.

Hello Disney

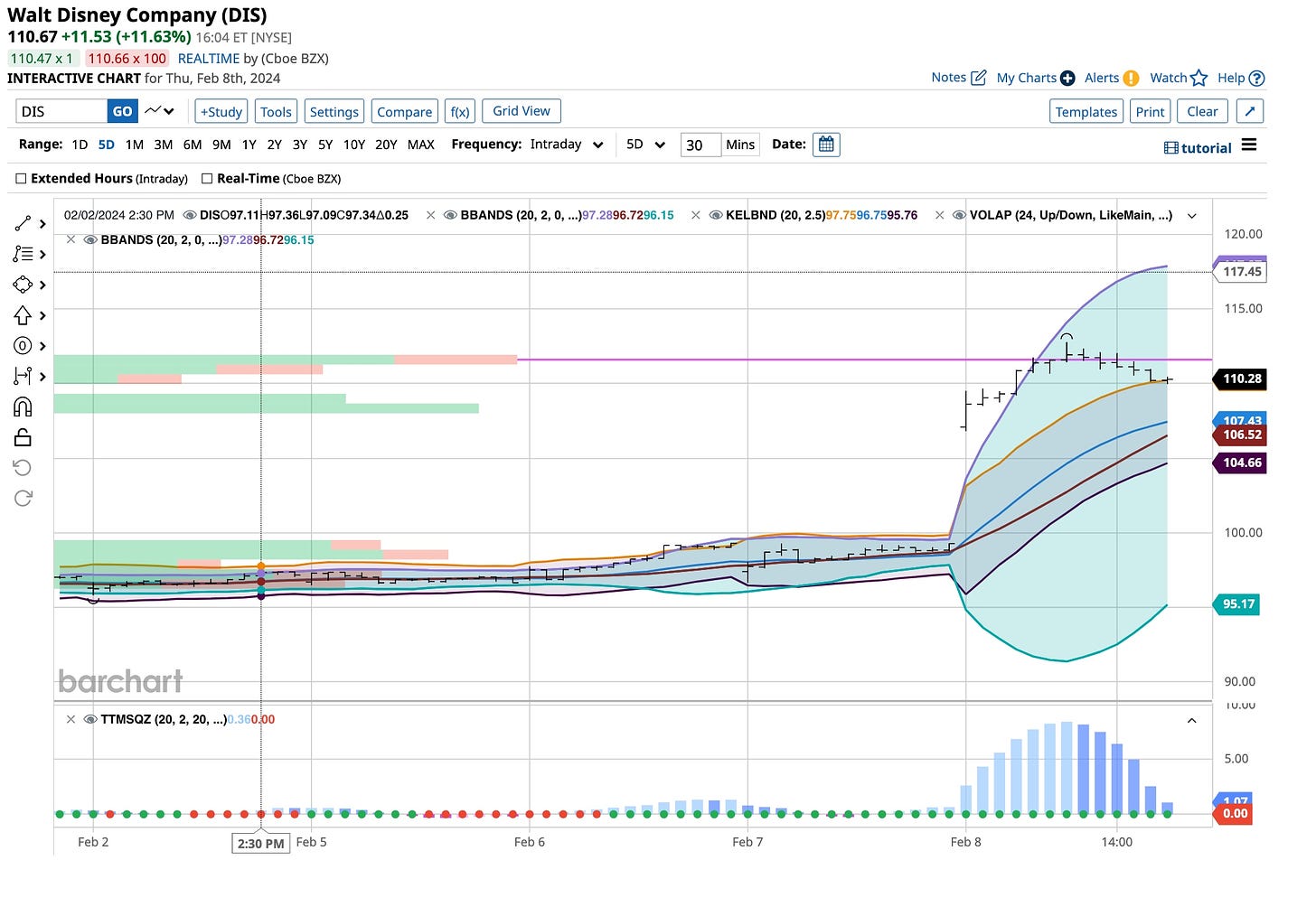

My average price on my most recent Disney purchase is slightly below 80. I bought it outright and with the use of 80 puts. In any case, I still own it. Yesterday, before they announced earnings I bought some short term puts for about $2.00 each when DIS was quoted around $97.00 a share.

The stock is trading around $110.00 a share as I type and I still own every share. It is not that I got lucky, rather it was good planning. Sure, I lost 3/4 of the total value paid for the “insurance”, that happens and that’s why buying “puts” is considered to be just that, insurance. What it preserved for me was a 13 point higher upside in the stock. I’ll be happy to “rinse and repeat” this strategy going forward as the battle for the “heart” of the company is just taking flight.

Not Everything Works Out

It good to be human and as I’ve said many times, I’m human. I’ve been patient with my entry points on the “short side” with Cocoa. To say I was taken by surprise by its upside today is an “understatement”. As I have said many times, this is a very small portion of what I manage and I’m usually early. I adjusted my strategic planning and will “double down” if Cocoa hits 6,000.

Right now I’m sitting with about a 4 point loss on six contracts. Is Cocoa done yet? I am not sure, no one is but I’ll take my lumps if it is not. Again, I’m only human and to lose and then learn from your mistakes is how we all learn, right? I don’t know about you but it is certainly the way I do.

So that is it folks. I’m busy, I want to get the first couple “Udemy courses ‘finished so you can buy them for $39.99. If you do get on board early you are really, very smart. If you jump “on board” with the initial offer that is coming to you again, hopefully this weekend, you’re smart. I’ll tell you more about it over the weekend but always keep in mind, I appreciate your patience. My best always to everyone.

Come gather round children wherever you are. Bob Dylan was and still is my favorite but face it, at least I can still understand what he’s singing and saying listening to was recorded and sold years ago. I’m sure it is the same for you so take some time and give this a listen or two or three. The times they are a changin’ and they are going to keep on changing. Jack be nimble and Jack be quick. The more you listen and learn you will also get more nimble and hopefully quicker. I can only teach as much as you are able to take in. Listening and learning works. It’s worked for me for years and hopefully it’s going to work for all of you today.