I’d hoped to present an analysis and update regarding the many securities and stocks I follow, some in my managed portfolios and those I monitor for various other reasons. Time does not permit me to do so in a single article so I’ll address that issue over this next week or two in several segments.

Quite often when I address what I consider “Modern Investment Management” I will often wonder how best to illustrate what I read, listen to and write. I have my ears and eyes open at all times. What I see is often disturbing but it’s essential to share cynical operatives as interpreted. While most simply look for the ‘next best’ investment, to me it’s just as important to reveal the failures of the ‘system’ as it operates today. With my experience, over more than a half century, these become apparent.

The Disappearing Chinese Wall

A Chinese wall or the ethical wall is an alleged information barrier protocol within an organization designed to prevent exchange of information or the communication that could lead to conflicts of interest. A Chinese wall is quite often established to separate people who make investments from those who have access to confidential information that could improperly influence the investment decisions. Wall Street firms generally require these safeguards to protect against insider information being used and ensure that improper trading does not occur. In reality they do not exist. Within the everyday structures of the firms we “trust” on the street, these curtains or walls are transparent such that one side is the beneficiary of the other and vice versa.

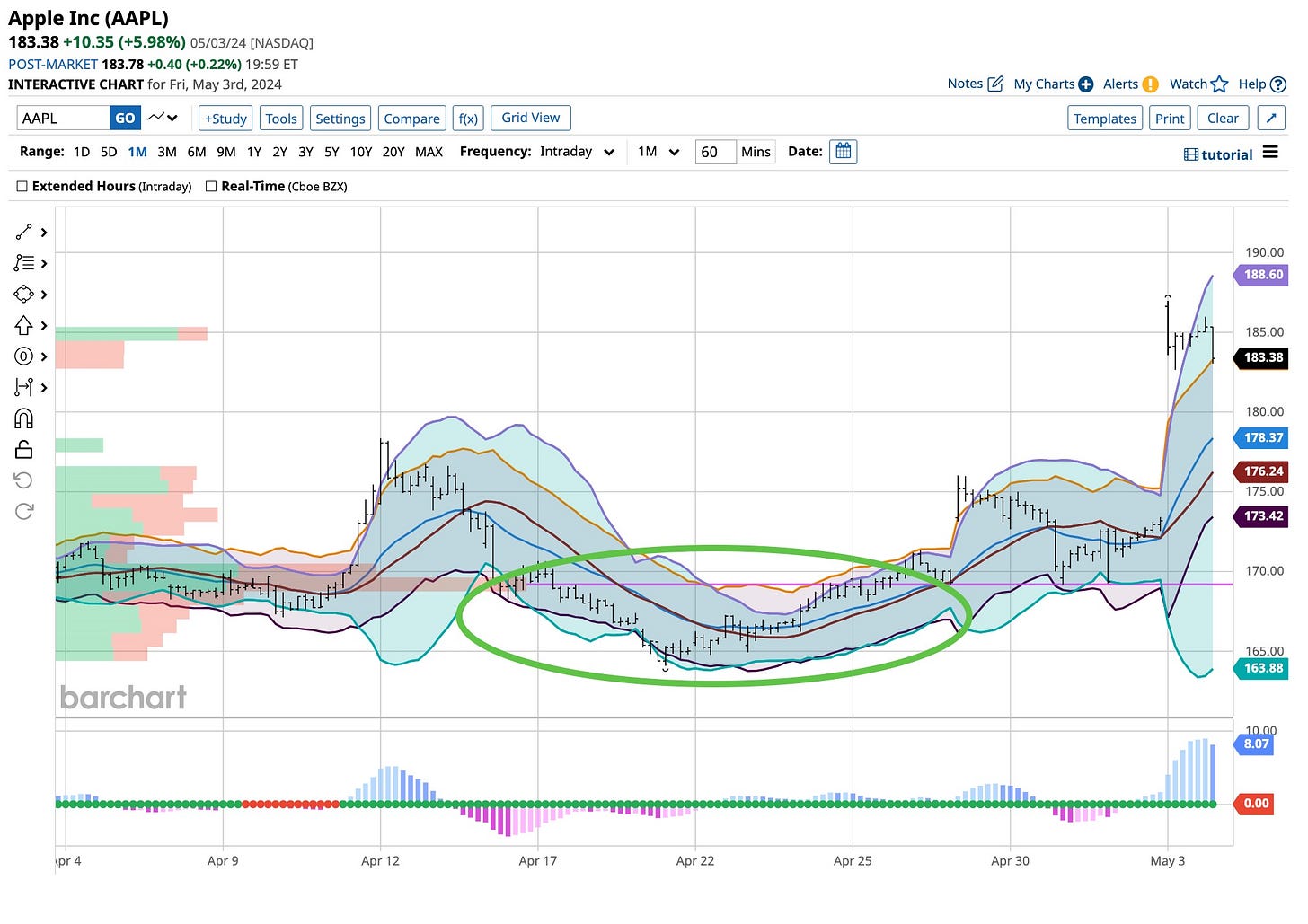

Far too often, the research side of these investment houses remark about what people should expect given an earnings report or related informational assessment. Have you ever closely watched what happens? It took place last week when Apple reported that its earnings exceeded “street” estimates. The stock ran higher in the aftermarket and the following trading day. What happened inside of these walls was not unique, more so it was planned as most analysts of the stock reduced their estimates so that Apple would beat estimates. You, the trading public were the victims but there was more.

The stock traded much lower prior to this announcement as the “street” knew more than they exposed. More than likely, the “news” they knew was coming was ‘shared’ internally making a purchase by the “institutional side” of the firm ‘easy’ despite the retail side effectively being told of the downside revisions. Essentially the information that developed between these two alleged walls enabled a buy side versus a sell side to develop assisting the powers that be to plan to the retail investors detriment. There is no doubt that incidents of this nature happen more frequently than not. Investors are often the last to know as they do not receive the internal information until released. I see a pattern emerging especially given how stocks are priced in the public realm. It’s a full time job to analyze this information and one we use but it takes time. The Ticker courses is where we discuss this process, especially in the “mortar” section of courses designed to help you be aware. It happens folks, right under your nose as the Chinese wall is more so a penetrable curtain designed to take advantage of retail investors.

Share Buybacks Should Be Illegal

Up until the early 1980s, share repurchase programs were illegal. By repurchasing its own shares on the open market, the company’s insiders would have an advantage that can be construed as market manipulation. Nonetheless, during that period of rampant inflation, the Securities and Exchange Commission deemed it as another mechanism to return shareholder value beyond dividends. In 1982 Rule 10b-18 was passed and the SEC made it a valid move to combat high inflation. Instead of engaging in the expense of expansion, companies just tweaked their “share supply” so the stock price kept up with inflation. This set loose a problem, one that has influenced the overall market.

Goldman Sachs reported a six-year high in overall stock buybacks and mergers worth $625 billion as of the end of March. They forecast the continuation of this trend, with many S&P 500 firms ramping up repurchases by over 13% by years end to $934 billion and then crossing the $1 trillion milestone in 2025. There ought to be a law against a “market manipulation” technique like this but given the 1982 decision it’s legal.

By artificially tampering with supply, much like central banks do with fiat currencies, companies create a false sense of stock demand. In the normal irrational waters of the stock market, stocks are distinctly overvalued. Such large expenditures to boost stock value displace resources for growth. Instead of investing in employees or research and development, the purpose of the company shifts to financialization.

Apple currently faces antitrust charges. It just increased share repurchases. Dividend payouts were also increased by 4%. If the latest antitrust lawsuit were to break those ecosystem walls, such as imposing “extraordinary costs on developers, businesses, and consumers”, Apple’s value proposition would likely lag behind buyback efforts.

Apple’s Bogus Share Repurchase

Apple recently unveiled a $110 billion share ‘buyback’ plan, sparking investor debate. The program, the largest in history, aims to return capital to shareholders as Apple plans to repurchase $110 billion worth of its own shares. CEO Tim Cook emphasized the company’s commitment to shareholder value. However, some experts question the move’s effectiveness. Concerns include potential financial engineering and diversion of resources from innovation.

Many analysts have criticized this buyback as simply a sign of overall desperation and suggested Apple is struggling to find new growth areas. Critics fear the buyback plan could hinder Apple’s ability to compete in ‘emerging’ technologies. There are general worries that the buyback will worsen income inequality, benefiting those very wealthy shareholders over employees. Critics argue that prioritizing shareholder returns could exacerbate social and economic disparities. Some experts believe the plan could offset dilution from employee stock options and stabilize the price during market volatility.

I see it a different way. It’s basic market manipulation similar to how “meme” stocks operated a couple years ago. Value failed to materialize but share buybacks prevailed keeping the demand for these stocks higher. The powers that be knew what strategy was being planned and internally took advantage of it. The retail public was suckered into following the “herd” to their overall disadvantage. The Chinese wall is dead but its effects are alive. Despite being an ardent user of Apple products and until recently being an investor in the company’s stock, we’re looking for an entry point to buy some

”out-of-the-money” put options and go short the stock.

Thanks For Following Us

When we kicked off The Ticker a little more than a year ago, if you told me that tens of thousands of people would follow me here, on LinkedIn posts and The Ticker Free Community I would have laughed. There’s many great writers to follow so why us? It seems to me the answer was simple. We have decades of experience and we don’t just tell you what you want to hear.

It has taken us a long time to get to this point. The Ticker Free Community is our way to keep you informed. Naturally we’re going to populate that chat room as our opinion matters but so does yours. Over the coming weeks we will email you a short note and an invitation to join us. It’s a great step to better understanding market developments and introducing you to The Ticker courses and our “1-on-1” tutorials. I know how to teach and those who acknowledge that they “don’t know everything” will listen, just like they did when E.F. Hutton talked years ago.

Back to the great outdoors for me today. It’s been raining here in Texas and the grass is growing wildly. For me it’s a great way to enjoy the outdoors and think about what is next in today’s world. For my better half it’s a way to say I care. Everyone should do that more often than not as it’s a simple way to say thanks. Face it, we owe it to others to say thank you every now and then,Humility is important, give it a try, it works.

I remember being at the Stanley Theatre with Ron Bartlett on September 23, 1980 as Bob Marley performed what was to be his last concert. There was a “green” haze over the audience. You didn’t have to “light up” but most people did. Marley was a unique talent, one whose message remains strong to this day. He and The Wailers sang one of their favorites, “I Shot The Sheriff”. He ended with the “Redemption Song” but we all knew how much he loved everything he sang. Sometimes it’s best to maintain rules in this society such that no one party gains an advantage over another. It’s time to take a look at removing the effects of share buybacks and leveling the playing field. Marley would have approved.