It’s a Friday during the summer but for one reason or another, it’s different from other weekends. There’s always something to learn. Today that deals with macroeconomics and related interest rate futures and ETFs and our favorite “meme” stock, GameStop.

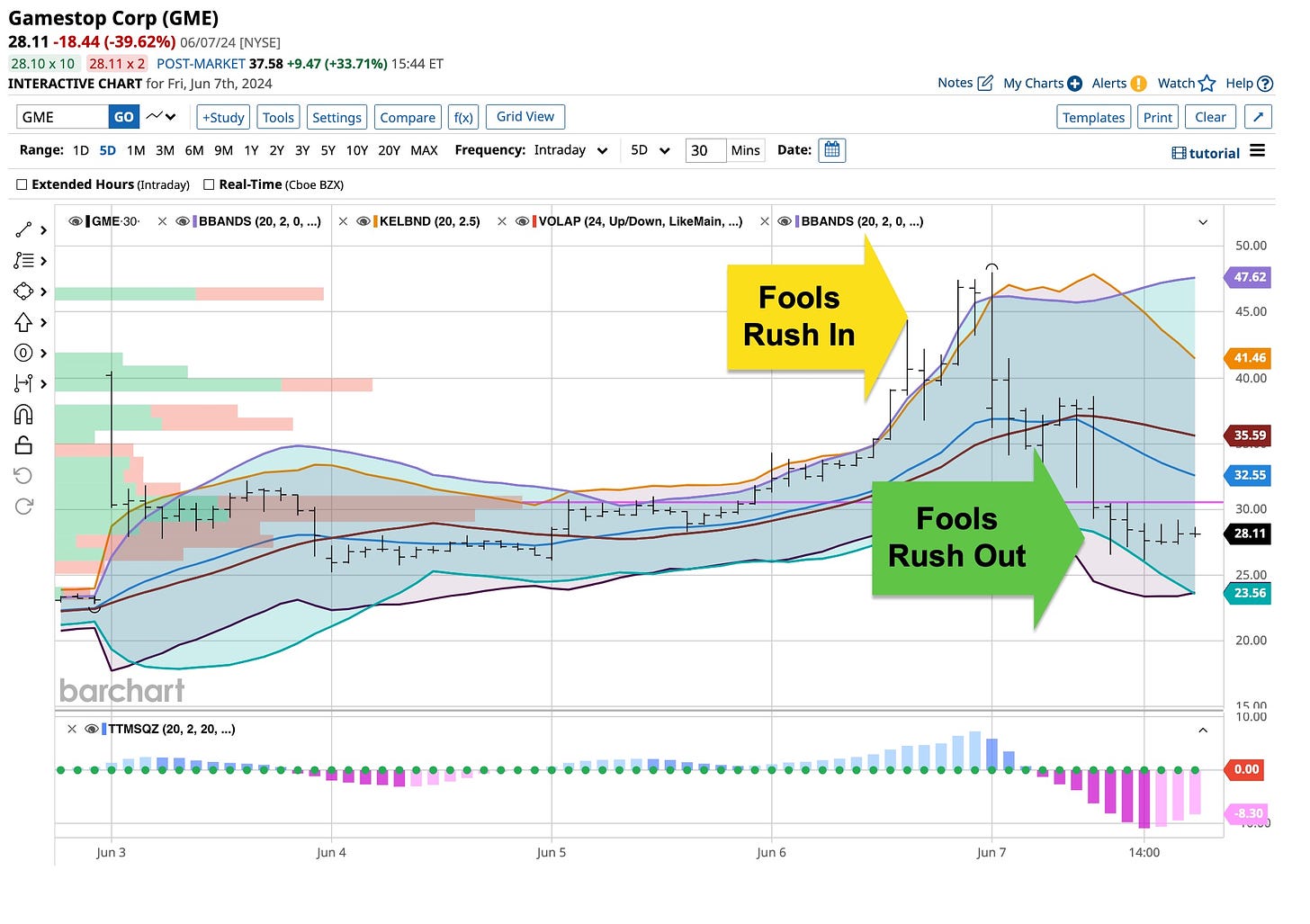

I’m a strong believer in doing nothing, sitting on my hands, and more often than not just being “boring”. Last night, the “herd” took GameStop over $60 a share. It would have been a great “short” in a normal world but borrowing shares was impossible. I know, I tried. The shares available were far too pricey for my blood so I just watched.

It’s not easy to teach my philosophies in today’s market as traders think they can pick the bottom and top of everything they hear. After all, with the online tools available it seems we’ve created more of these monsters. I “trade”, not as often as before because the interest and ability are simply not there. I like support and resistance levels along with reversion to the mean strategies but I’m longer-term in nature. I know that the “herd” is often wrong. They buy at the top get scared and sell at the bottom. It’s easy to watch them make mistakes as well as to take advantage of their errors.

We talk about that in The Ticker. What actions I see and how I react are presented in a manner you can follow and learn from. Over the last year we’ve published more than 300 articles here on Substack, most looking to teach from our experience. The Ticker is where I talk more about the actions I’m taking on a real-time basis. We’re offering a short-time introductory offer so check it out. Lifetime membership is inexpensive at $99 so there’s no reason not to join with us. Stop on by, we’re looking forward to your being a part of making profits and learning the “right way”.

Everybody Wants A Job

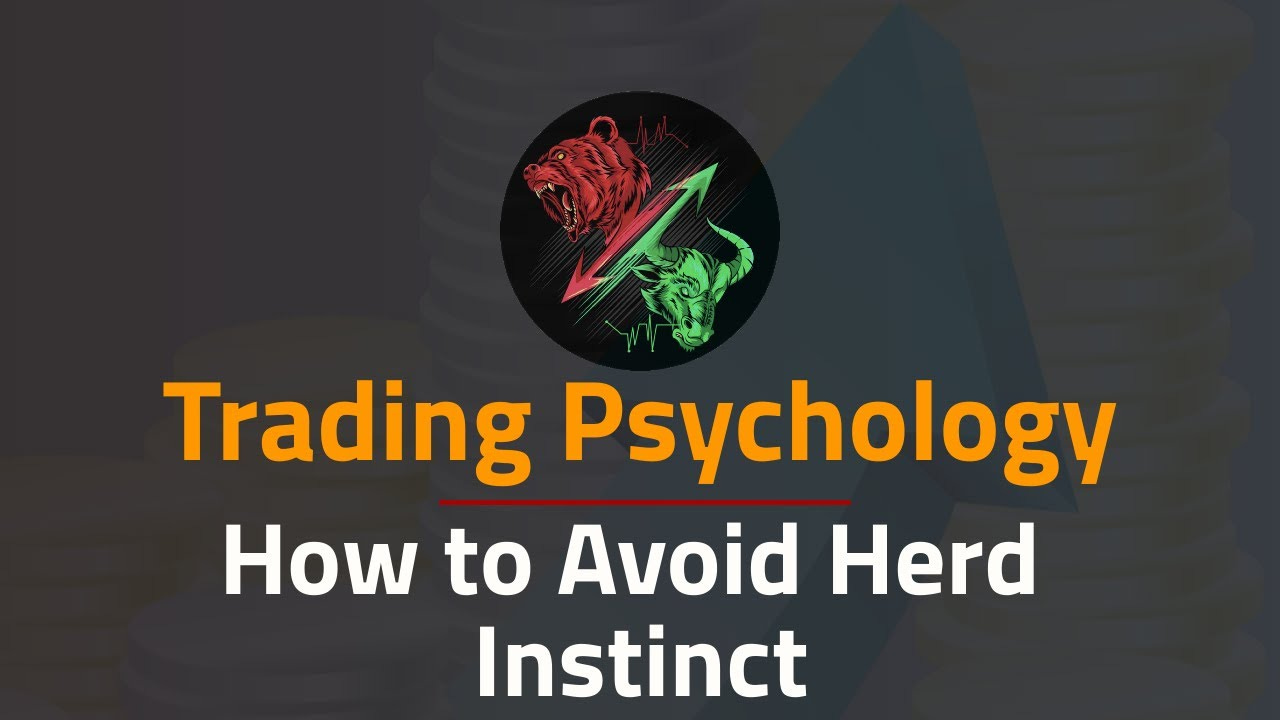

Nonfarm payrolls came in about 100,000 over estimates yet the unemployment rate hit 4%. Go figure, eh? I’ve never had much faith in these numbers but Jerome Powell and the “powers that be” depend upon them. So do traders and “hedgers”, especially those in the commodities markets.

Last night the prognosticators were alive and living in an alternative universe. Metals were predicting a decrease in U.S. interest rates similar to what was “happening” over in Europe. They didn’t get it but the price action in the metals told me to use ‘trailing’ stops to protect my gains. That’s exactly what I did. I’m now sitting on a bigger pile of cash as the only hedged holding in my portfolio is gold bullion. I booked an almost 10 point gain in silver. I’ll be back but given the uncertainty in the overall direction, I’ll be happy earning 5%+ while I’m waiting. It’s summer folks and there is nothing wrong with being on the sidelines.

“Meme” Stock Mania

Why did the chicken cross the road? Naturally, the chicken wanted to liquidate shares in GameStop but with trading “stopped” in the stock he couldn’t. I’ve been involved in this industry for more than 55+ years. I’ve worked “undercover” for decades and there is little I haven’t seen or experienced. From “pump & dump” schemes, to ‘bucket shop’ Long Island entities, to “short sale” abusers during the financial crisis, they are all out there. The SEC and regulatory authorities are out there protecting you. The problem I see is that they are also protecting their own, the “big boys'“. They just go after those that do not have the “firepower” to fight back but that's a “book” I’ll write another day.

Today’s “cover boy” is Keith Gill, an online stock influencer known as “Roaring Kitty” is back. Yesterday's surge was the latest in a bout of volatile trading in the struggling videogame seller's shares that kicked off last month after the influencer returned to X.com after a three-year hiatus. The ‘Roaring Kitty’ channel on YouTube on Thursday showed an upcoming livestream scheduled for noon on Friday.

On Monday, GameStop shares closed over 20% higher after Gill's ‘Reddit’ post showed a $116 million bet on the stock after a three-year gap. Gill was a key player in the 2021 rally in GameStop and other so-called meme stocks, fueled by individual investors. He is back but is what he’s doing legal?

Gill developed a cult following of traders who fueled sharp gains in GameStop, which scalded hedge funds betting against the struggling shopping mall retailer. Earnings on the stock proved that GameStop still struggles with shrinking sales as video game fans shifted to online purchases.

The U.S. Securities and Exchange Commission investigated the meme stock craze of 2021, ultimately finding that marketplace systems worked well. Maybe we should just elect Gill to Congress. I hear one of his biggest followers is Nancy Pelosi.

A Trade Recommendation Is Published

Extra, extra, read all about it. That’s right, I just published a trade I’ve been looking to make for about two weeks. I’m patient, I waited but the time was right to strike. If you are interested in my real-time actions then you have to join us. The Ticker is designed so I can do just that. Let you know what I’m thinking and doing as I do it. Here I’ll be happy to teach you what to do, the “right way”. On The Ticker I’ll post what I’m doing so the choice is yours. For lifetime access at $99, it’s priceless but the choice is yours.

I remember sixty years ago when Dusty Springfield took over the charts with “Wishin & Hoping”. I’m not a wisher or a hoper but far too many of you are. If words like wish, hope, pray or even think are involved in an investment or trade I usually do nothing. I do not believe in uncertainty and that’s what these words suggest. I do a great deal of research to come up with a word I trust, “know”. Either I am 90% sure of what actions I’m about to initiate or I pass. It’s a great strategy that everyone should follow.