Always remember that summer is upon us. Swings in the various markets watched are apparent. It’s times like these that having a plan and sticking to it works. Being on the sidelines is a viable alternative especially when the books are thin. That’s our plan for summer. What’s yours?

Nothing Changes

We’re kind of in a suspended economic environment. So what’s changed? Not much, at least that’s the way Jerome Powell reads it. He must have the same plan and he is just “sitting on his hands”. Higher for longer makes sense to me. I still have little to no faith in the 2% inflation target. It’s going to be met at some point. I hope it happens a bit sooner than not so I can enjoy the “irrational exuberance” that will be created. I’m not going to hold my breath waiting and neither should you.

Tactically The Markets Are Troubling

Recently, Bank of America warned of "tactical divergences" that could dampen the expected values for the S&P 500. The SPX achieved new all-time highs this week, but the advance-decline line, 5-day put / call ratio, the US high yield OAS, the Corporate BAA spread, and new 52-week highs did not confirm.

The number of new lows remains contained. If the number of stocks at new 52-week lows moves higher the risk for a deeper correction would increase. The NYSE and the Russell 200 are lagging the S&P and NASDAQ. That’s something to keep watching. It is interesting to note that retail investors, evidenced by record highs in cash holdings through money market funds, are hesitant. Retail money market funds reached a new record high of $2.45 trillion last week. This suggests investors remain cautious.

Memories

I’m doing my best to share my years of experience with those who think spending a few years “learning the ropes” is sufficient. Let them believe what they want. It takes time, effort, and mistakes to learn anything. Experience is priceless. Besides, learning curves are just that. If you’ve faced challenges in the past you’re better able to handle them today and in the future. It’s good to learn. I do it every day. How about you?

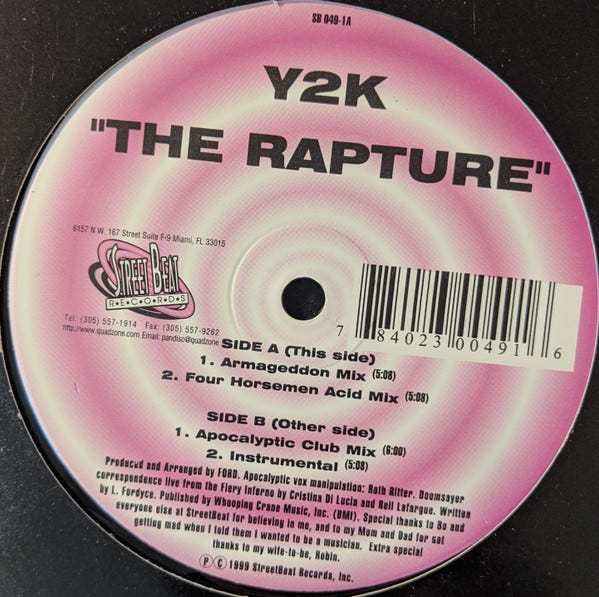

More than just a few individuals were active in the markets in 1999-2000, but many participants today were not. I remember it all, looking at charts and writing about the craziness in markets as the fears of “Y2K” and the boom of “internet” filled headlines hit the airwaves. It was quite the dichotomy.

Back then, the S&P 500, particularly the Nasdaq, rallied harder each day than the last. Market breadth looked pretty weak, as the big names were soaring, forcing indexers and ETFs to buy them to keep their weightings. Reinforcing this positive “feedback” cycle fueled markets higher day after day.

I remember those days clearly. It was the “gold rush” of the 21st century for investors. Interestingly, much like then, today we’re witnessing investors chase anything related to “artificial Intelligence.” Just like the internet had most companies adding a simple “dot.com” address to their corporate name in 1999, today, we are seeing an increasing number of companies announce an “AI” strategy in their corporate outlooks.

The difference versus today was that companies would advance regardless of actual revenue, earnings, or valuations. It only mattered if they were on the cutting edge of the internet revolution. Today, the companies racing higher on artificial intelligence have actual revenues and income. But does that difference remove the risk of another disappointing outcome?

In 1999, as the “Dot.com” bubble swelled, ETF providers and index tracking managers were forced to buy increasing quantities of the largest stocks to remain balanced with the index. Given the proliferation of ETFs and investors’ increasing amount of money flows into passive ETFs, there is a forced-feeding frenzy in the largest stocks. The top 10 stocks in the S&P 500 index comprise more than 1/3rd of the index. In other words, a 1% gain in the top 10 stocks is the same as a 1% gain in the bottom 90%.

As investors buy shares of a passive ETF, the shares of all the underlying companies get purchased. Given the massive inflows into ETFs over the last year and subsequent inflows into the top 10 stocks, the mirage of market stability is not surprising.

That lack of breadth is far more apparent when comparing the market-capitalization-weighted index to the equal-weighted index. Concentrated flows into these “largest” market-cap-weighted companies increase the market capitalization of those stocks to levels well above that of the 1999-2000 “Dot.com” bubble.

The forced feeding of the largest companies in the index, while reminiscent of 2000, does not mean there will be an immediate reversal. If this is indeed a bubble in the market, it can last far longer than logic would suggest. Just as it was in 2000, what eventually causes the market reversal is when reality fails to live up to expectations. Currently, the sales growth expectations are an exponential growth trend higher.

While it is certainly possible that those very expectations will be met, there is also a considerable risk that something will happen. We are again experiencing another of these speculative “booms,” as anything related to artificial intelligence grips investors’ imaginations. What remains the same is that analysts and investors once again believe that “trees can grow to the sky.”

“Trees don’t grow to the sky” is a German proverb that suggests that there are natural limits to growth and improvement. The proverb is often associated with investing and banking where it is used to “describe” the dangers of maturing companies with a high growth rate. A company with an exponential growth rate will achieve a high valuation based on the unrealistic expectation that growth will continue at the same pace as the company becomes larger.

The larger a company becomes the more difficult it becomes to achieve a high growth rate. Firms tend to become less efficient and innovative as they grow as diseconomies of scale become more prevalent.

The internet craze in 1999 sucked in retail and professionals alike. Then, Jim Cramer published his list of “winners” for the decade in March 2000. He just did it again. Such is unsurprising, as endless possibilities existed of how the ‘internet’ would change our lives, the workplace, and futures. While the internet did indeed change our world, the reality of valuations and earnings growth eventually collided with the fantasy.

No, today is not like 2000, but there are similarities. Is this time different, or will trees again fail to reach the sky? Unfortunately, we won’t know for certain until we can look back through the lens of history. I love history and remember what most have failed to experience. The answer remains uncertain, but it’s worth watching.

In “The Way We Were” Barbra Streisand made “Memories” a hit. The song was great, the movie was better. My head is filled with experience. All I ever try to accomplish is to take “what’s between my ears” and deposit these events between yours. Most of you are listening but then again, those with little experience think they know it all. Let ‘em think whatever they want, especially those who have never seen an Internet crash or a financial meltdown. Powell is doing a pretty good job but he’s no Volcker, no one is but it’s going to take time. The world is different today than it’s been but that’s just a perception. Reality is coming and if history has its way, nothing is certain.