I don’t know about you but I love baseball. Growing up in Pittsburgh, Pennsylvania, with the likes of Bill Mazeroski and Roberto Clemente as my heroes in the 1960s and early 1970s, it was easy. The Steelers did not run a close second until the middle of the 1970s so there wasn’t really much choice. I remember the glory days of “Forbes Field”, beating the Baltimore Orioles in seven games in the 1971 and 1979 World Series and more. They were great memories and I miss those days.

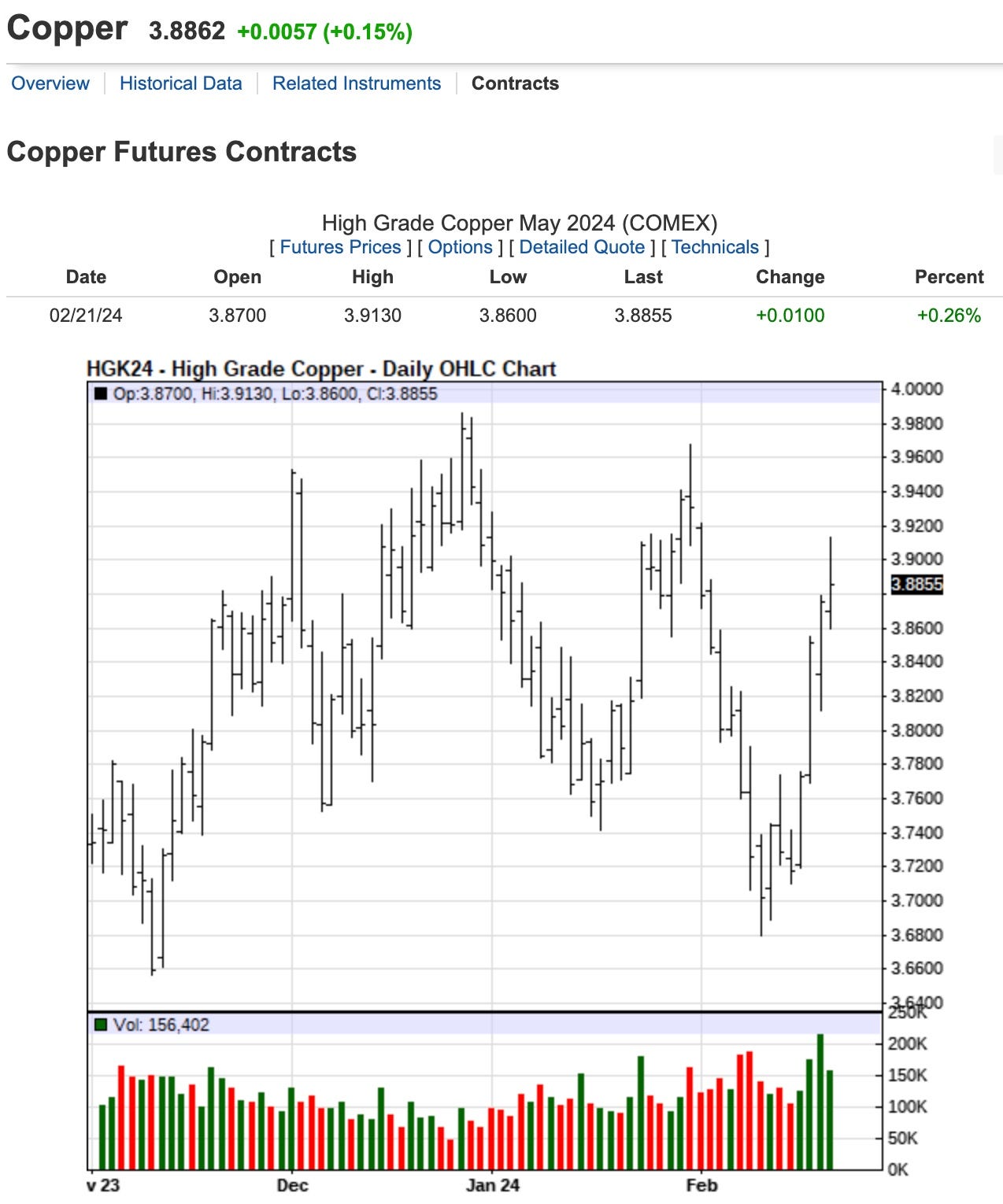

What I do not miss is its seasonality. It’s “baseball season” again. You know what that means to a good, seasonal futures trader; it’s time to buy copper. The Chinese lowered their interest rates to hopefully bolster their flailing real estate market. Although I do appreciate the gesture I view it as being too little too late.

What can I say other than it’s nice to see a major economy lowering rates. It would be nice if Australia and New Zealand, the true “leader of the pack”, would do the same. I see a little cloudiness in the old “crystal ball” when it comes to both but we can hope that is the outcome, right?

I’m Long May Copper

But it’s only February you might remark, eh? You are right but if you take a closer look at history, you’ll find that the May Copper contract is heavily traded. It should be, it’s spring and it’s time to build. Some real estate professionals build apartments, houses and more. Me, I’ll just jump on board with copper contracts and ride their wave. Hope all I read of what’s happening is right.

Remember, I am usually a little bit early but I do have a bona fide trigger, it’s baseball season and it’s spring. Again, China lowering rates helps but it would be even nicer if the world followed especially New Zealand.

I Struck Out This Week As Well

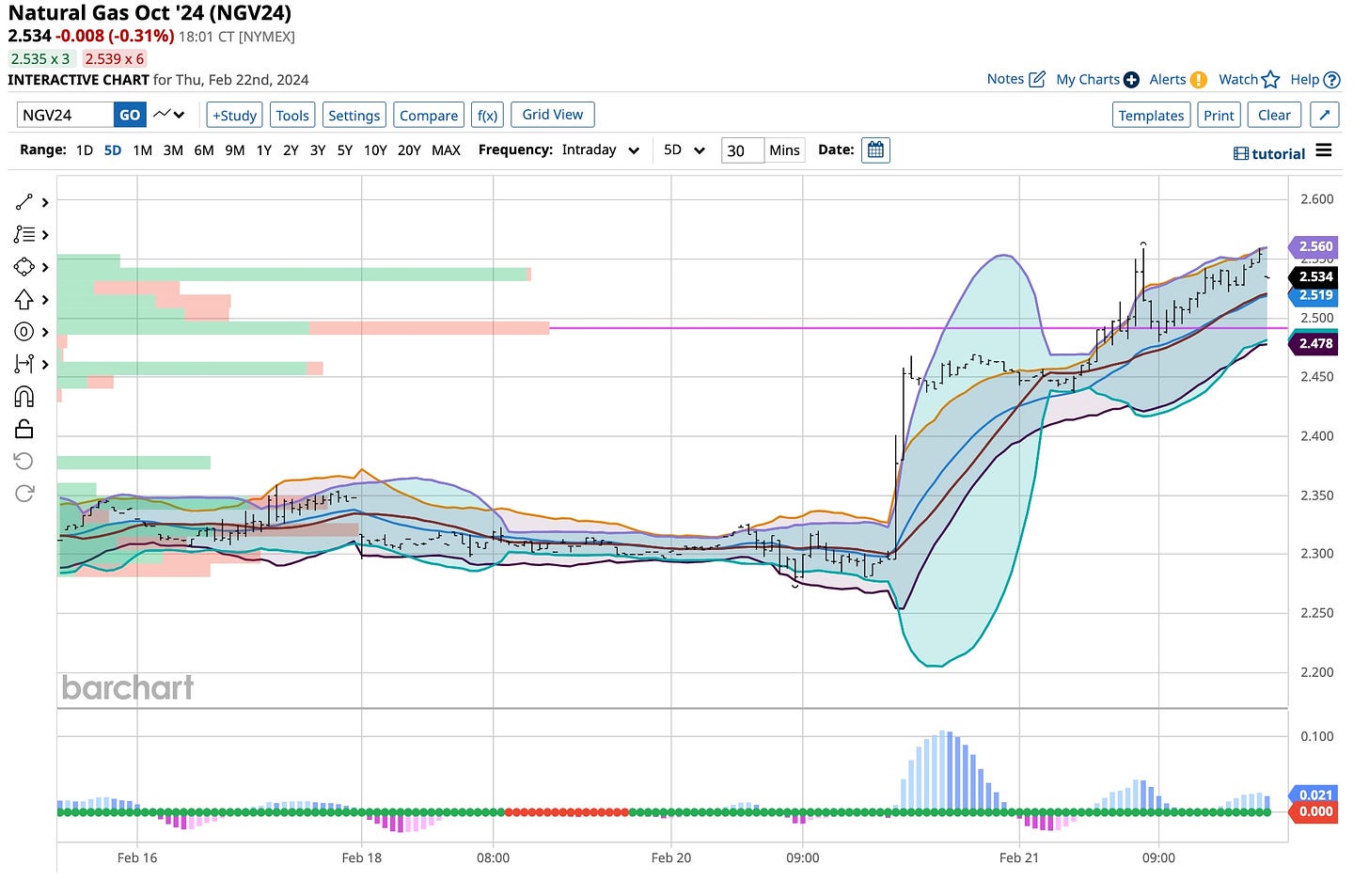

You cannot win them all despite what you perceive, see and believe will happen. I put in a couple GTC orders on 2024 October Natural Gas calls and missed on all three. In my book “three strikes” and you are out; the “rules” simply do not change. Neither do mine. Natural Gas took off, didn’t it? It was about time but face it, I got greedy. Think about it, there are three positions that exist in the market, long, short and flat. I’m in the “flat” world on Natural Gas this time around. At least one of my “GTC” orders hit the “bid list” but there were no trades. I should have chased the “ask” at that time but I did not. I’m not a chaser, I’m a watcher and chances are I’ll get another chance. How about you? What’s your style? Are you a gambler looking for that next ‘big hit” or are you more like me just taking into consideration the “opportunities” that prevail in the markets today, especially those that have “performed” historically well in the past.

Are You Familiar With The Internet Bubble

I am but unfortunately too many participants in today’s market are not. For me it was a really simple explanation that surfaced, one that was “proven to be true” over time. The size of the “information pipeline” and the conduit upon which it was carried was not “big enough or good enough” to handle what was being put through it. In other words, the flow of “data’ from one point to another could not meet the actual need of what was required. Copper wires can only do so much, fiber optics were just in their infancy and wireless, as we know it today was happy to be “2G”. That’s a lot different than we have today with “5G” transmission, isn’t it?

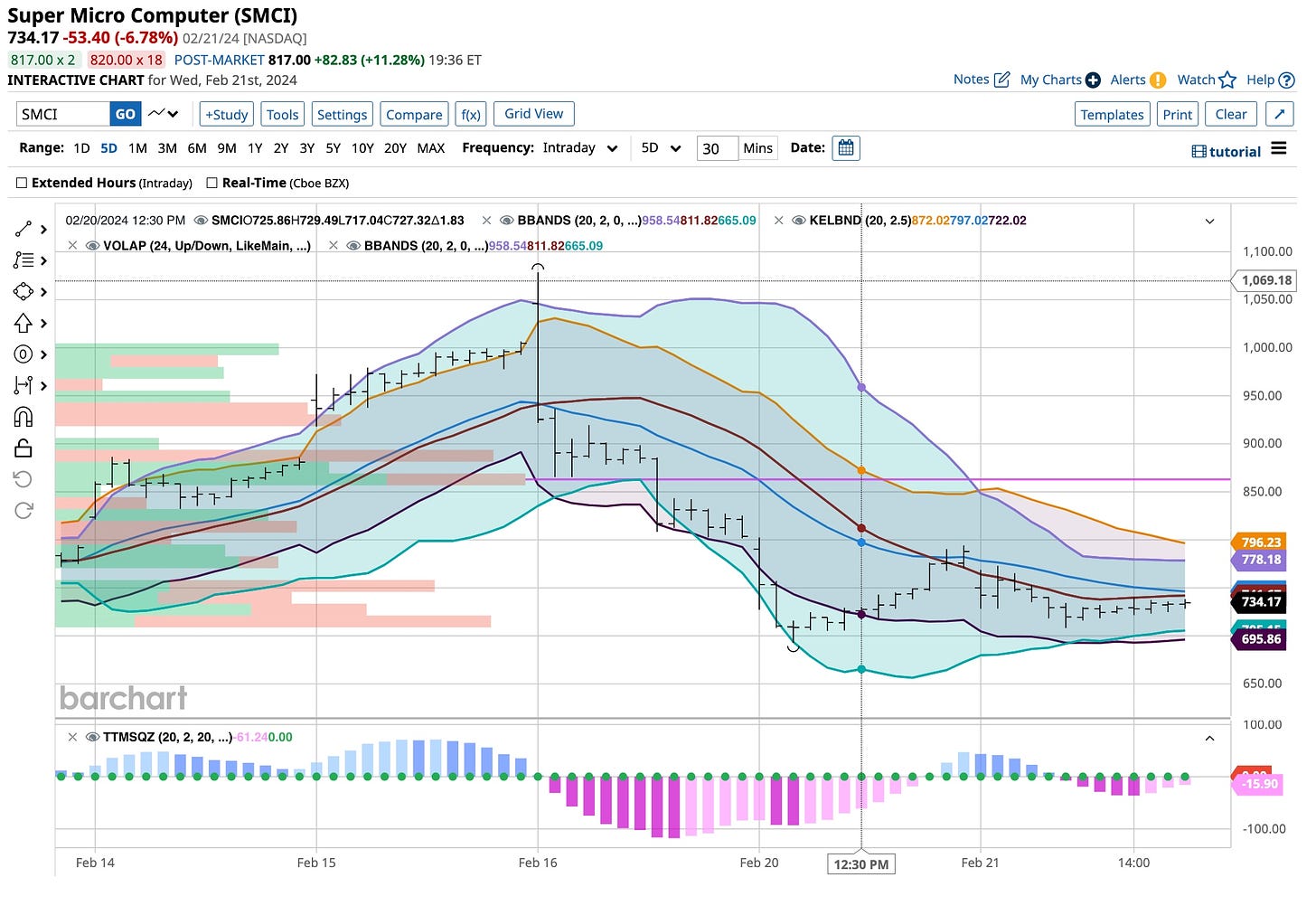

Another point I remember was when it happened, the actual “bubble” and decline in about 90% of what was traded took some by surprise. Buying and selling the Internet stocks was all they knew. They learned quickly that making money was important but for some it was too late. The “herd” won as many simply “followed it”. Is that what we are seeing in today’s market with the “Magnificent 7” and the “AI” stocks? Time will tell but from my perspective I’m just happy to watch. Sure, I’m looking for a “double top” technically in a couple AI stocks. Maybe I’ll get it, maybe I will not but I’m going to keep on “watching” and more importantly wait for it to happen.

For all of you who “live and die” by this industry, its “earning reports” and the usual “fifteen second charts” you live by, here’s a couple charts you should follow. They are long term in nature for your eyes and use, they are five day charts. They do not scare me but they do tell me that my plan to look for the “second” top in each one of them is the right one. The end is near. What do you think?

Like always, for those of you who are long these stocks I hope I am wrong and I wish you the best. I see dark clouds but there is always a silver lining. People, traders, or at least traders who think they are always right learn the “hard way”. They finally start to listen to what we have to offer. The smart ones actually become better at what they are doing or trying to do. It’s been 55+ years folks of doing the same thing the “right way”. Maybe it is time you listened and learned.

Do you remember Chicago’s Harry Carey. What. fixture he was in the “radio” booth. I bet some of you never listened to a radio. Maybe growing up when I did was a blessed event. In a way I’ve seen it all. All I have had to do was adapt to “what’s next” and I’m pretty good at that. How about you? Are you able to remember what happens when? Do you think history rules, or at least seasonally the same outcomes usually come to fruition? When I think about it I do. When I make plans based upon these “rules” I’m usually right. It seems to me that history matters and so does baseball season. Enjoy America’s game and take in a couple games as time allows, especially at some of the better baseball parks this country has to offer. It’s going to cost you a pretty penny but the memories cannot be replaced.