Well I guess there were a few surprises on the central bank horizon I didn’t expect, oops, good to be human. “Too little too late” or “simply wrong” seems to be the real reaction of the street but most of the “big boys” are already in the Hamptons so we’ll have to wait until next week or the week after; July 4th is coming. Face it, we’re living in an age like “The Great Gatsby”. Welcome back to the “Roaring 20s”. Let’s hope we don’t repeat its aftermath.

"The Great Gatsby", written by F. Scott Fitzgerald was set in the 1920s. It took place in the prosperous and glamorous Long Island, New York. The novel provides a vivid portrayal of the Jazz Age and explores themes of wealth, love, and the corruption of the American Dream. We are back, aren’t we?

Nick Carraway, moves to West Egg, a not so fictional town on Long Island, to pursue a career in the bond business. He becomes neighbors with the enigmatic Jay Gatsby, a wealthy and mysterious man who hosts extravagant parties at his luxurious mansion. Jay’s known for his lavish lifestyle but the source of his wealth is unknown. Maybe he did a few deals with the “big guy”.

Nick befriends Gatsby, who confides in him about his wanting to reunite with Daisy Buchanan, a woman he had a brief romantic relationship with. Daisy, however, is now married to Tom Buchanan, a wealthy, arrogant man. That doesn’t stop Gatsby..

Nick becomes entangled in the complex relationships between Gatsby, Daisy, and Tom. He witnesses the destructive effects of the pursuit of wealth and social status. The characters' lives are marked by deceit and infidelity; the true emptiness that lies beneath the glittering surface of most extravagant lifestyles. Ah, the Roaring 20s, eh?

Tragedy looms, culminating in a fateful event exposing the characters’ true nature and the hollowness of their pursuits. In "The Great Gatsby", F. Scott Fitzgerald explores then destroys the “illusion of the American Dream”. It’s impossible to recapturing the past. It’s not impossible to repeat it; unfortunately history repeats itself far too often

In an upcoming article, one I’ve been working on for months, the “Roaring 20s” are compared to the last decade when rates were kept far too low for far o long. For now, as they did, or did not do in the 1920s, we find ourselves in a similar situation. Greed, love, success, acceptance, disillusionments that due to our own actions have created problems far beyond our reach to correct. Shame on us or at the very least the “powers that got us here”. It’s time to change the script but first let’s look at what the central banks did today.

The BOE Raises 50 Basis Points

The Bank of England has spoken. Perhaps a little too late but the BOE just surprised the markets with a 50 basis point hike to interest rates, its 13th consecutive increase. I guess they’ve finally decided persistently high inflation is not a good thing. Hey Ueda, are you listening? Japan’s next, sorry Warren.

Fresh data on Wednesday, expected to see a reduction from the prior month’s number came in “unchanged” cementing an upside move but 50 basis points surprised market participants worldwide.. Core inflation, which excludes volatile energy, food, alcohol and tobacco prices, came in at 7.1% year on year, up from 6.8% in April, marking its highest rate since March 1992. They’re not done raising rates. Neither are we but will it make any difference?

Japan Inflation Hits 42-Year High

Japan's core consumer inflation exceeded forecasts in May and an index excluding fuel costs rose at the fastest annual pace in 42 years. Undoubtedly broadening price pressure like this will keep Ueda and the central bank under pressure to phase out its massive stimulus. Finally time to short the JGBs, eh?

Core consumer inflation has stayed above the central bank's 2% target for 14 straight months. Like Yellen’s original assessment of inflation here in the United States, that cost-driven inflation will prove be temporary, is just as wrong in Japan as it was here. Will they ever learn? Today said the chances of recession have abated. Exactly what is she putting in her tea? I want some.

The so-called "core-core" index that strips away the effects of both fresh food and fuel, closely watched by the BoJ as a key barometer of domestic demand-driven price trends, rose 4.3% in May, accelerating from a 4.1% gain in April, marking the biggest increase since June 1981. The Nikkei didn’t crash until 1989. What’s really going on in Japan’s government controlled financial markets?

BoJ Governor Ueda stressed the central bank's readiness to keep its ultra-loose policy until inflation is sustainably around 2% yet accompanied by wage hikes. Ueda’s also said core consumer inflation will slow back below 2% by this September or October. Does anyone know where he buys his Saki? It must be very good as these thoughts are simply delusional in reality. Ueda’s only way out, to maintain the BoJ’s dovish stance, something Buffett’s fallen in love with, would be to revise up its inflation forecasts at its next quarterly review in July. My only fear with this type of decision would be that other central banks would take similar actions. I’m short the Dollar against the Yen so I really hope this idea is wrong but in today’s world, who knows.

Another Tool The Fed May Employ

The Federal Reserve together with the ECB, hinted it may mop up as much as 90% of the money they pumped into banks over the last decade. It’s just like watching “The Three Stooges” or “Laurel & Hardy” fixing mistakes they are already responsible for making. Weren’t these guys responsible for getting us into “this fine mess” in the first place?

The world's two largest central banks have been raising interest rates at a brisk pace to fight inflation while unwinding some of their massive bond purchases. They were indeed responsible for flooding banks with cash when price growth was sluggish and borrowing costs sat at zero. Why should we trust that these institutions will “do the right thing” after years, no decades of “doing the wrong thing”? It’s beyond me.

The Federal Reserve Board, estimates the Fed could reduce total reserves from their current $6 trillion level to between $600 billion and $3.3 trillion. That’s a big spread. Have they taken into consideration the real world effect China dumping treasuries on the market would do with that plan? What a “monkey wrench” that would be, eh? If I remember correctly we just raised the debt ceiling. Did anyone give any consideration as its effects on “money supply”? I guess they’ll just print more money then just suck it right back out, right?

Im my opinion they should keep raising rates and continue to drain money from the system as they are currently doing. Either way banks, components of the Russell 2000 are in trouble and that spells trouble for the Russell. It’s already leading the way to the downside and for good reason. To quote myself, yesterday I included a tidbit relating to history repeating itself. Hell, our central banks are scurrying to obviate a few of the mistakes they’ve made so history, unchecked does repeat itself.

“In the U.S. commercial bank lending came to an abrupt halt falling by more than 1.5%. Three previous times, in 1975, 2002 and 2008, metrics of this nature emerged. Each time the S&P 500 lost about 50% of its value.” That’s why I’m short the Russell too. What’s your thoughts?

Lots to do this weekend down here in Texas. It’s barely going to break the 100 degree mark, a cold wave, so we’re going to catch up on the yard work and spend time with family and friends. Catch up with y’all on Monday unless that meteor hits. That’s what Greta Thunberg and Al Gore predicted, right? They’re never wrong. Have a good one.

I’m just a “young” 68 years old looking to help you become the best damn investor or trader you can possibly be. Everyone learns at their own pace. If you pick everything up the first time through, great but if not email me at david@thetickeredu.com so we can further help. Again, let me know what you want to learn, I’m all ears.

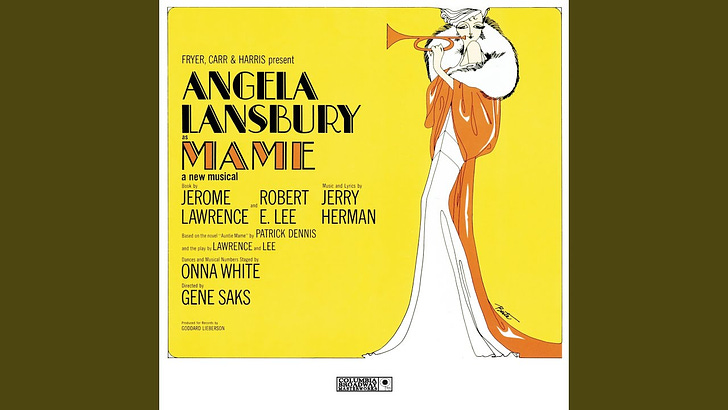

By now you might have figured out that I’m a fan of Broadway Two of my costars from “Bye Bye Birdie” made it to Broadway. I didn’t; two left feet but such is life. Listening to songs like “Open A New Window” from “Mame”, especially when Angela Lansbury sings it, gives me hope that maybe there’s someone out there who will “open that new window” and devise a new way to deal with man-made problems. Volcker did it; let’s find a few more like him and finally solve the financial problems we’ve created versus just putting another temporary bandaid on it..