In today’s “streaming” world you can change channels at will and watch whatever you want. Between China, North Korea, Ukraine, Iran, the European Union and back here in the United States, macroeconomic and geopolitical events could form the basis of the next hit series, “Spin Baby Spin”. You wouldn’t have to hire a single actor, just do a few outtakes from what’s presented on whatever news channel, blog or YouTube video you watch. You can’t make this stuff up but you can react and there’s lots to react to on any channel of whatever “boob tube” you’re watching.

As Predicted China’s Dumping US Debt

One of the questions often raised is “what happens if China decides to sell”? The US government has about $32 trillion in debt outstanding, interest rates are surging. That has sent interest payments to comprise 3.6% of GDP in the last quarter.

Japan remains the largest holder of US debt. China’s share has fallen from 26% to 15% between 2014 and 2023. As a percent of overall US debt, China’s share has fallen from about 9% to 4%. Together with increased interest rates, it’s no wonder why the price of bonds are under pressure. China needs capital; gold’s next if it hasn’t already begun.

Ueda Flags End to Negative Rates

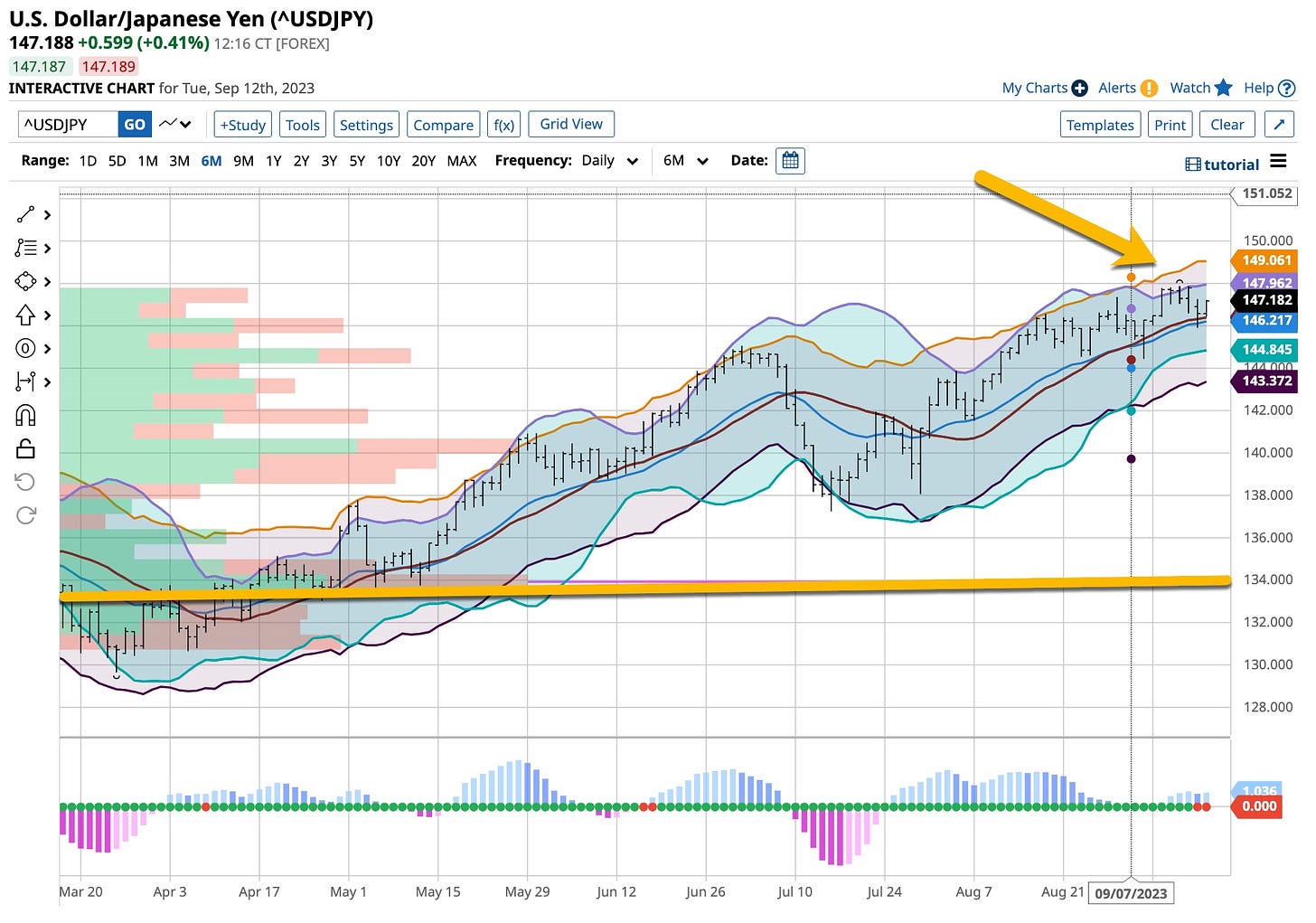

The Yen rose by 1% at one point yesterday after Governor Ueda told a local newspaper that the BOJ could have enough data by the end of the year to determine if their rates should stay negative. Ueda said the 2% inflation target was in sight, allowing the bank to begin considering a tightening policy. Wage growth has also somewhat picked up in Japan. Quite a difference between what you’re wishing for between our countries.

A move of this nature would end nearly a decade of negative interest rates, narrowing the gap between local and U.S. rates and easing some pressure on the Yen. I’m on the long side of the Yen and expect to be for several years. Currency trends are not only cyclical they’re longer term in nature. Remember, even though it moved higher, it was still trading close to 10-month lows as rising U.S. interest rates make the low-yielding currency far less attractive, while worsening risk sentiment also dented its appeal for carry trade.

Consumers Begin to Spend Less

After staving off recession for longer than many thought possible, the US consumer is finally about to crack. Analysts are now questioning if spending is stalling. Given this “about face” the “recession” word is starting to creep back into the discussion.

Right now, the US economy appears to be speeding up rather than stalling. Growth is forecast to accelerate in the third quarter on the back of a recent pickup in household spending, which jumped in July by the most in six months. Taylor Swift can only do so many concerts and “Barbie” and “Oppenheimer” movies are few and far between in the “woke” theater culture themes that are far too prevalent today

Delinquency rates on credit cards and auto loans are rising. Student loans are about to come due again for millions of Americans who benefited from the pandemic freeze on repayments. The amount of money in circulation is falling as well. This is not exactly the prescription the current administration anticipated going into the 2024 election. Whatever happened to “Build Back Better”?

Back to the Dot-Com Bubble

Arm Holdings Ltd.’s initial public offering is already oversubscribed by 10 to 15 times and bankers stopped taking orders. Arm is still considering raising the price range of its initial public offering as well. Sounds like we’re back in the late 1990s / early 2000s if my memory serves me correctly.

The stage is set to benefit those people lucky enough to get shares at the IPO’s price no matter what it is. Every single “newbie” trader will “stand in line” to get their piece of the “rock” and that’s what it will be, a rock. I’ll be a buyer of VIX December 20 calls when the IPO hits the street. If anything, I’d be a buyer of Softbank. It just might get the valuation it envisioned of $60 billion to $70 billion before being forced to go the IPO route.

Basic Commodity Prices

Many who “trade” futures are really nothing more than “speculators” on indices. Next time you have a chance take a look at the real price drivers of inflation. Chances are it will not come as a surprise to you when inflation raises it’s ugly head tomorrow.

Crude Oil WTI - 89.00

US Cocoa - 3,650.00

Orange Juice - 330.00

US Sugar #11 - 27.00

Food components & the fuel used to get them from the fields to the shelves are going higher in price. There’s really nothing in place to control these costs. People are going to eat; inflation will be around for quite some time; so will higher interest rates. Soft landing is once again off the table.

Off topic, although it appears that Biden, et al., have done a few questionable things in the past, bringing an impeachment enquiry only further muddies political waters. If you want to see a change in the political landscape just legislate effective policies that will “right a sinking ship”. The other way to do it is simpler; just let the policies Biden has put in place to fail. I’m wondering how he’s going to refill the petroleum reserves while simultaneously shutting down production. Maybe he got a few barrels from Iran for the $6.0 billion he just sent their way, after all only five “prisoners” were released, maybe that leaves $1.0 billion out there.

Back to work folks. It’s below 100 degrees here for the next couple days so I’m going to go out and “paint” the grass, that is after I rake up all of the leaves from the trees that didn’t stand a chance of survival this year.

Just like Journey sang years ago with it's hit “Wheel in the Sky” we’re in a world that is just spinning. Unfortunately it’s spinning a bit out of control at this time. Respect is an important criteria of leadership; we’re not respected in today’s “soap opera” world. Why should we be? Between lying about where he was the day after 9/11 to making a deal with a prime enemy on its anniversary is despicable, we’d be better off if Biden took more naps and vacations. I don’t have a “horse” in this race and as stated before would like to see some “new blood” on all sides. otherwise all we are and how we are perceived in this world is more like “As The World Turns”; it’s time to end this “soap opera” and start putting a realistic plan in place versus some “woke” version that will not work, short or long term.