It’s only appropriate to say thank you. Here’s to another year of learning. I have always said that I learn something every day and you should too. Having that in mind, today’s post is on me and it’s a good one.

These markets are baffling at best. If not for this being a political year I might believe that interest rates are not heading lower and with recent employment results might be going higher. It’s a thought but in reality this economy has proven me wrong before. It is doing a pretty good job of doing it again but with grocery prices 40% higher there is only one way to go and that is to watch and listen.

Diversification Is Essential

From “start to finish”, as The Ticker courses have been assembled with diversification in the forefront. I practice what I preach as a long-term investor, trader and hedger. It is best to follow my lead especially knowing that anything can and will happen. Event after event tell me that’s true. I’m a “boring” kind of instructor and it shows in all the courses, especially the third course that I’m finishing, “mortar”, over the next weeks.

I’ve been a strong believer in beating inflation with respect to the millions of dollars I manage in Roth IRAs. That bring diversification into play. I’m always going to hold a position in actual gold bullion selling pieces of it as the precious metal heads higher. I have correctly taken a technical approach to silver and a seasonal one to copper. The “poor man” metals offer opportunity and buttress my overall approach.

Stocks are important but again, as noted, I’m a “brand name” bottom fisher looking at stocks that for some reason are “out-of-favor”. It may look to be an easy task but it is not. It is very time consuming and I use many of the tools I provide in the first course when I openly speak about “The Tools I Use & How I Use Them”. Again, I am here to “teach” and if you are truly “listening” as we did in the glory days of E.F. Hutton years ago, you will too and take the courses The Ticker offers at your own pace.

These positions offer a hedge to my primary position of earning 5%+ on the treasuries I hold and waiting patiently for the Japanese Yen to strengthen versus the U.S. Dollar. Hey Ueda, enough of the head fakes, the 150 level is simply too high.

Rebalancing Works

Rebalancing is not just an exercise I speak of throughout The Ticker courses, it’s one I follow especially when I pick the right stocks. Remember, I am human and not every selection is going to be right. That’s why when stocks like Disney and Dollar General go higher I sell a “piece” of them and invest the proceeds into ones that have declined. It’s a simple technique that everyone must follow. You’ll never go broke taking profits.

Events are important, especially board meetings and earnings reports. Throughout all courses I do my best to teach everyone about options. It’s not an easy method to learn but I’ll keep using it as I practice rebalancing. Selling “out-of-the-money” call options against current positions and buying protective, usually shorter term “at-the-money” put options protects my gains. The worst thing anyone can do is to give up a profit. I know first hand how difficult it is to be right and outperform the benchmarks. Doing this for years makes it simple for me and if you are truly following what I post here on Substack and LinkedIn you’ll be rewarded.

The Ticker Courses

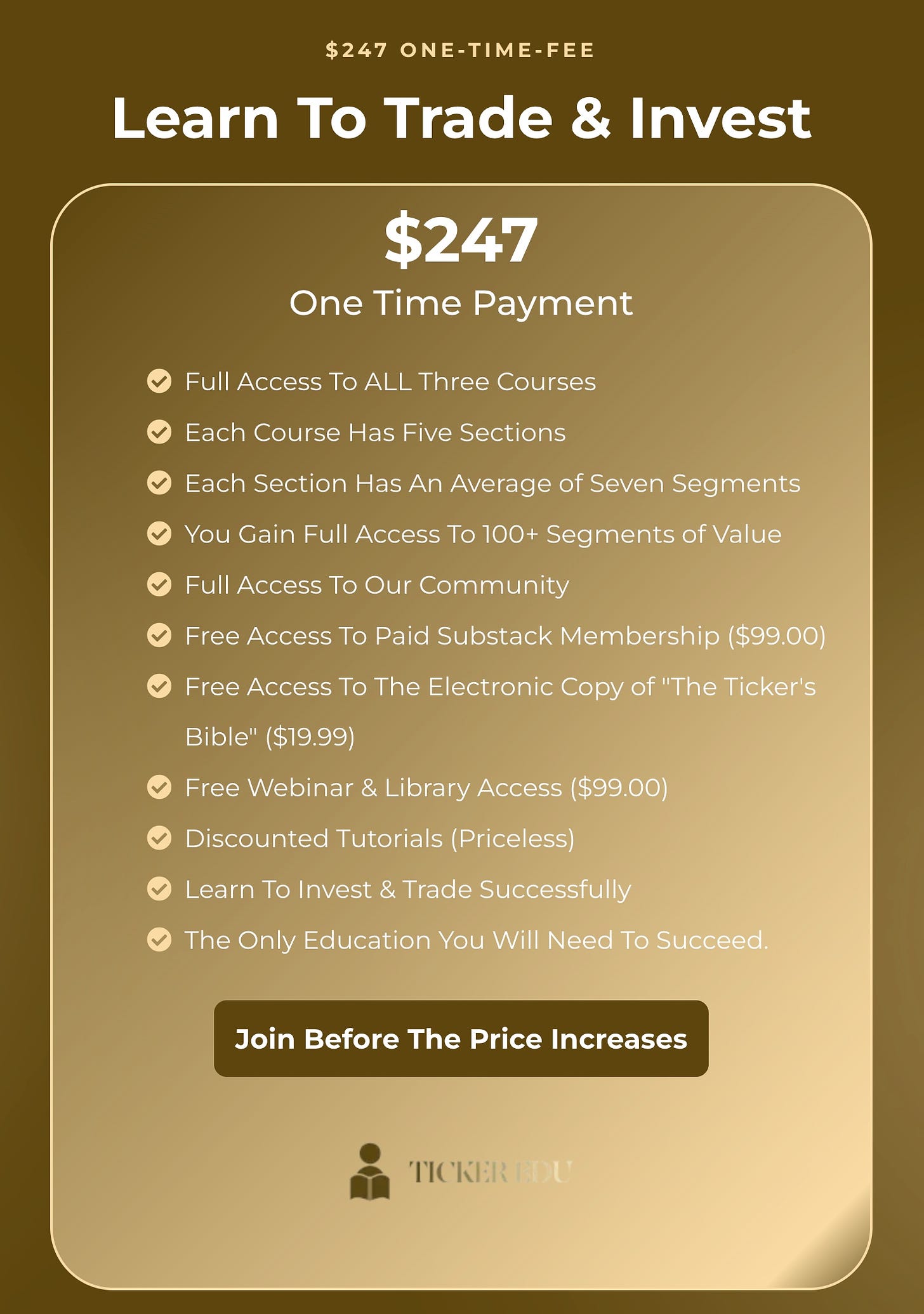

I can lead horses to water but I can’t make you drink. Not only does learning take time it’s not free. That’s why I’ve taken the time to develop The Ticker and keep on making it better.

We started out with a reference oriented book, “The Ticker’s Bible”. People don’t read in today’s day and age so it became apparent to me that online courses were necessary. I was right as the first two courses, soon to be complimented by a third course proved this to be the answer but it got me to thinking. Some people simply want short, simple videos that address the issues.

Bring on The Ticker “Library & Webinar” series. Remember, “Rome” wasn’t built in a day and neither is assembling the “Library & Webinar” series. It’s more than you think as for us, it has to bring a benefit to all of you who want to learn. Together with being new entrants on various social media, we’ve created a nomenclature to organize our thoughts. We’re sticking with the format of “Foundation - Bricks - Mortar” so we can teach. As I said, it takes time and we predict a June launch. Remember, Rome took a great deal of time to be built and I’m a very optimistic developer so if it’s not ready on time don’t take me out to the woodshed. It has to be right or I’m not publishing it.

For now we are offering The Ticker at an introductory price of $247.00. It’s a steal as we are giving away a lifetime membership here on Substack, a $129.99 value, a copy of “The Ticker’s Bible” in an electronic format, a $19.99 value and a lifetime membership to our “Library & Webinar” series, a $99.00 value. In essence, you’re getting all of the courses for free. Such a deal, eh? We think so but it’s our objective’s to make it better.

So what are you waiting for, check out The Ticker and sign up. Once we have all of the three courses completed, along with the “Library & Webinar” series, the introductory offer is going to disappear and prices will head higher. We understand that everyone is capable of becoming the “best damn trader or investor” they can possibly be. It is obvious that all anyone need to do is follow our suggestions, at their own pace, to get there. For $247.00, the price of perhaps a single winning investment or trade, you will but again, sign up now and take advantage of our “introductory deal”. You’ll be happy you did and we will too.

Thanks Again

I turned 69-years old yesterday and to be honest, I feel much younger than before. It is all relative but nothing has really changed except for the actual outpouring of wishes I received from everyone. You all told me something yesterday. This site and everything we are putting together for our mutual benefit is working. I haven’t had so many good thoughts hit my media ever and it’s all your fault, thanks. Keep those thoughts coming and take the time to check out The Ticker. As time allows, let me know what else we can do to make it a better experience for you and sign up, take advantage of our ‘deal’ and learn, learn and learn some more.

While you all are considered to be my “family” it’s very important for me to note that “my integral family”, the one that adopted me years ago as being “part” of their own are “simply the best”. I’m very hard to buy something for as there’s nothing I need. In response, my far better half still bought me what I needed, picked up and “candled” a piece of my favorite pie and enjoyed my birthday with me. More so her kids and more so their kids sent me a video where they sang “Happy Birthday” to me. Tears filled my eyes as no one has ever done that for me. I’m a real simple person but between all of her kids and grandkids I felt special. Thanks to you all and remember, if I make it to my 70th birthday we’ll all do something really special.

Fifty-four years ago, in my “formative” years Crosby, Still, Nash & Young” released a hit song on the radio I think about every day. “Teach Your Children” is important as that’s exactly what my Mom and Dad did. From an early day of support, drilling into me how important it was to learn rings true. I learn from everyone daily. Those who think they “know it all” do not. Which category are you in? I find that new ideas are important, especially when they get me thinking. Giving back’s critical as well. Being that premise was imbedded into me by my parents, it’s easy to act in this way. I hope you all are learning as that’s my objective. Thanks again for all of your guidance.