In the past I have chimed in as it relates to “bubbles”, what they are comprised of and what the results can and will be. I’m busy with a “courses” deadline of March 1st and for once, I’m going to hit that deadline, probably. Nonetheless, Mahdi Nikpour once again surged to the forefront with an article on the subject.

No, we do not exactly see things “eye to eye” but then again, no one ever does and no one ever should. The difference of opinions in today’s world is important. Face it, in today’s world people see different aspects of the challenges we endure. One person it seems will see things from their own geoeconomics perspective and that’s critical.

Mahdi has taken his time to voice how he observes and understands what’s happening from halfway around the world. Together with others who will grace this thread over time, Mahdi has been a “breath of fresh air” and the comments received related to the positions he’s taken, supported by more than just his words is refreshing. They give me a chance to finish what I’m doing as well and with that in mind, I say thank you.

AI Hype vs. Dot-Com Bubble

Lessons from History in a Complex World

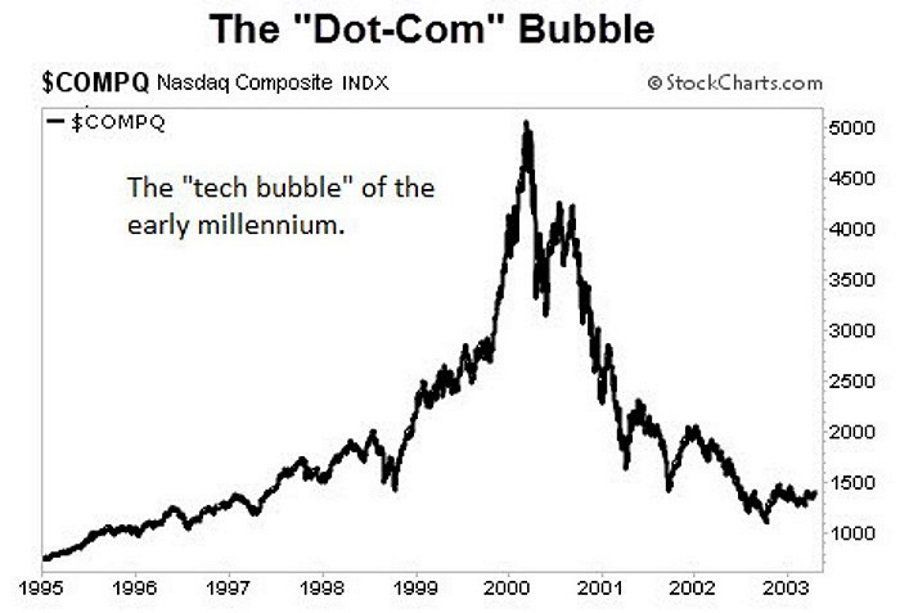

The rapid advancements in Artificial Intelligence (“AI”) have sparked concerns of a potential "AI bubble" like the Dot-Com” bubble of the late 1990s and early 2000s. All that excitement and hype around internet companies, many with sky-high valuations despite not yet proving their worth was real. Well, with the rise of AI, some folks are wondering if history might repeat itself.

Let's take a closer look and see if the AI boom is headed for a similar bubble burst. Both periods share features of rapid growth, speculative investment, and uncertainty. A closer examination reveals “significant” similarities and major differences in their underlying dynamics, potential consequences and policy implications. Nonetheless. everyone in most media channels keep chanting “buy, buy and buy”!

Similarities:

Rapid Technological Advancement & Hype: Both the “Dot-Com and AI” eras witnessed rapid technological breakthroughs, capturing the public's imagination and leading to significant investments in new companies. This most often meant inflated valuations based on future potential rather than current profits.

Speculative Investment & Market Volatility: Both periods experienced surges in overall investment driven by the belief of future growth and high returns. This led to market volatility, with very rapid price increases followed by sharp corrections as investor sentiment shifted.

Focus On Intangibles & Future Potential: Both “bubbles” involve the companies whose values were heavily dependent on “intangible assets and future prospects”, making it difficult to assess their true worth. The lack of “traditional” valuation metrics created uncertainty and contributed to market volatility.

Differences:

Underlying Technology & Maturity: The “Dot-Com” bubble was based on the promise of the Internet, a then-unproven technology with limited applications. In contrast, AI leverages existing technologies like computing power and data storage, making it arguably more grounded in reality and offering earlier practical applications across various sectors.

Business Models & Revenue Generation: Many “Dot-Com” companies lacked clear and sustainable business models, just relying on advertising or speculative ventures. In contrast, many AI companies are developing practical applications with clear revenue streams, such as in healthcare, finance and automation.

Regulatory Landscape & Policy Response: The “Dot-Com” bubble burst largely due to internal market forces. The potential “AI bubble” might be influenced by regulatory interventions. Governments and policymakers are actively discussing potential regulations for ethical development and use of AI, which could impact its growth trajectory.

Economic Perspective:

Inflation Concerns: Both periods faced rising inflation, prompting central banks to consider raising interest rates. However, the concerns in 2000s stemmed largely from a strong economy, while in 2024 they are just fueled by ongoing supply chain disruptions and the conflicts around the world, making soe delays in rate cuts and even some rumors about new rate hikes arguable.

Global Trade: Both periods witnessed concerns about slowing global trade, albeit for different reasons. In 2000, it was actually due to the “Dot-Com” bubble burst and its ripple effects. In 2024, it is due more so to “conflict-related disruptions”, protectionist policies and geopolitical tensions.

Economic Resilience: While both periods experienced economic uncertainty, the overall economic outlook appears more cautious in 2024. Headlines in 2000 point to a booming U.S. economy with low unemployment.2024 headlines highlight concerns about slowing growth and global headwinds.

Geopolitical Similarities:

Geopolitical Tensions: Both periods experienced “heightened geopolitical” tensions, with 2000 dealing with the rise of a “new” system in Russia and the ongoing Middle Eastern conflict. Remember, we are grappling with the ongoing war in Ukraine and Middle East conflicts. In addition, both periods witnessed major elections in the U.S.

Geopolitical Differences:

Nature Of Dominant Conflicts: The “dominant” conflict in 2000, though significant was largely regional. The war in Ukraine and Middle East conflicts in 2024 poses a broader threat to global security and economic stability.

Rise Of New Players: China and related emerging markets offer a key economic and geopolitical influence. This is a major difference, creating a complex dynamic that was not present in 2000 . We may even face new challenges as we can see a potential Space Nuclear Arms race in 2024.

Conclusion:

While “similarities and differences” exist in terms of rapid growth and speculative investment, the underlying technology and business models of “AI” differ from the “Dot-Com” era. This does not guarantee AI won't experience a bubble burst, but it suggests the potential consequences might be different.

Nice assessment Mahdi and as always well thought out and written. I thank you for your time. Naturally, while we look at things in a more similar way than not my real perception is simple.

First, in the “Dot-Com” area we saw losts of money chasing nothing. In reality, the pipeline for success was “2G” in nature. Today we have “5G” and more than likely a faster method on the horizon. That is important and represents a major difference. You are right, “AI” applications have real value. So did the Internet back in 2000 but everyone wanted a piece of the action and there was not enough to go around. I took a good hard look at “AI” and being a “beta” participant with Nvidia early I saw what they were buying and jumped on Super Micro Computer (“SMCI”) as being the “best of breed” in the needed technology to make “AI” work. I’m happy I did as without a question, their management team has performed and more than likely will continue to perform.

From my basic understanding of the markets, I am a believer that “what goes up must come down” and “AI” is no different. Continued consolidation of those who take their space in the industry to compete with current behemoths is obvious and that is going to continue. The leaders in the field are going to need to use their “minted currency”, their stock price, to buy some of these new ventures to stay ahead of the curve. They’ll need to spend some o their “stock price” invrease to stay in the lead and with that the price of the securities will meet resistance.

Regardless, I agree with your ovrall assessment and again thank you for your words, your time and above all for just being you. rom the start of our relationship you have distinguished yourself in many ways but in particular, I consider you a friend, thanks.

The Who is one of my favorites and “Pinball Wizard” ranks at the top of the list. I’m a true “pinball” junkie. I was one of the “wizards” that saved the industry during a time when it needed saving, the 2008 financial crisis. It’s hard for me to believe that pinball as we know it could have disappeared but in reality, that is what is happening with the “AI” craze. If you are not using “AI” you are behind the curve. No, I never adapted to the “games” kids play today but I did try. Being a mathematician at heart when I had the opportunity to jump into the “AI” world I did so with both feet. There is still a lot of time to do so. Jump on board, you’ll be happy you did,