Chances are we are not going to get through everything tomorrow but I’ll do my best to present enough of a discussion along with the following charts to get the message across. “Relationships” and changes in their dynamics affect the prices of commodity futures traded and subsequently the macroeconomics of the world’s marketplace. It is important first to understand that this occurs; secondarily realize this isn’t something you are going to learn then apply in a single lesson. Learning how to be the best damn investor or trader you can be is not a sprint; it’s a marathon. Let’s start with the Dollar as it affects everything as it’s affected by macroeconomic and geopolitical changes.

The U.S. Dollar

The Dollar’s still the world’s currency; how much longer that will be becomes more and more uncertain daily. Let’s leave that for another day unless you want to go “back in time” and review an article I wrote a while back “War With No Bullets”. China has many ways to fight that war; I hope we have a plan to counterattack, eh “big guy”, you have a plan right, not just “save the queen”, right?

Powell paused this week. That action was countered with rates are still going higher but the markets only reacted to the former and the Dollar retreated setting up the rest of what I’ll be discussing here and tomorrow.

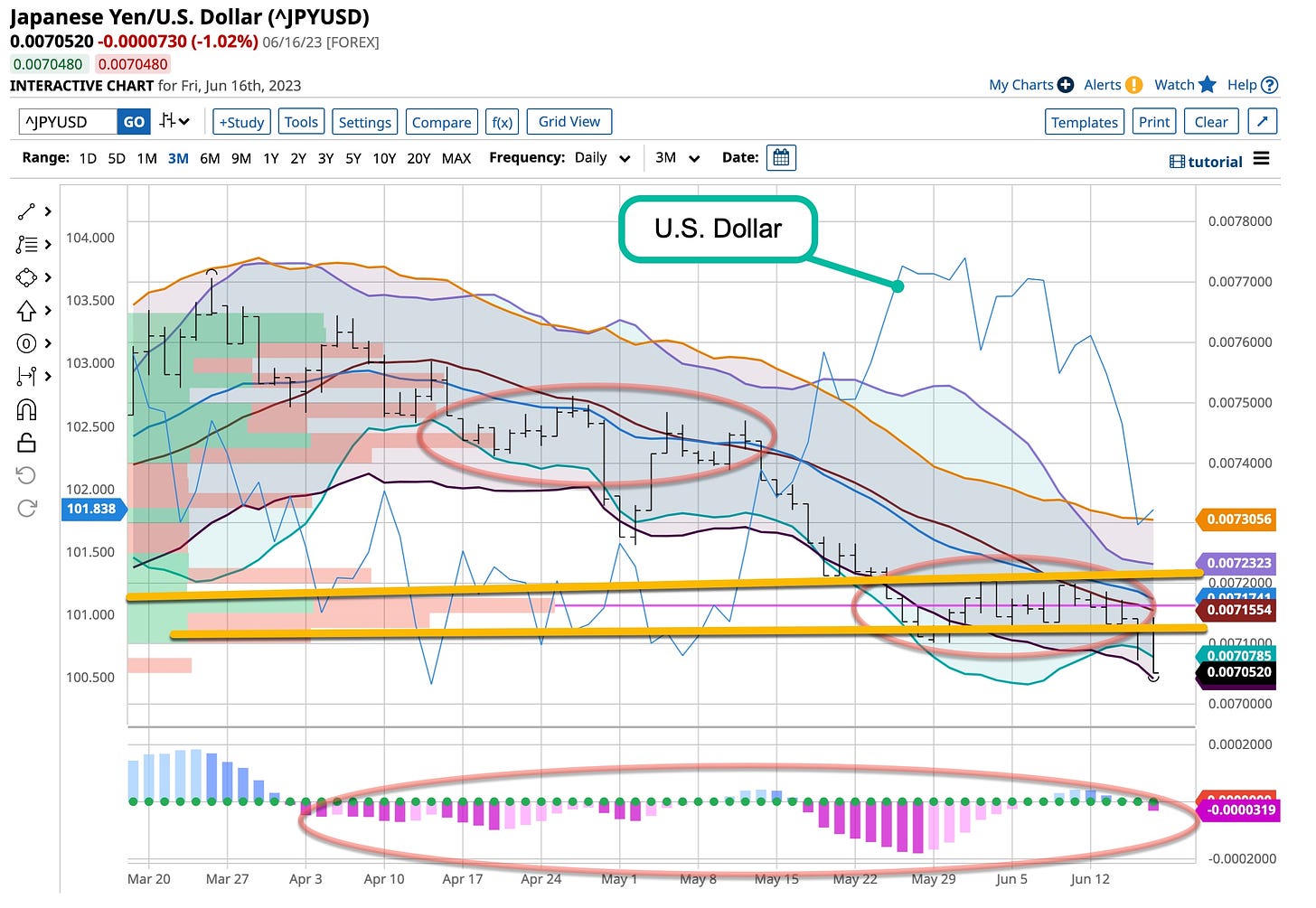

The Yen

The Ueda run BoJ left everything that’s kept the Yen weak for years in place again last week but times they are a changing. Inflation has been above their 2% target for much too long and the “natives” are getting restless. How long will Japan’s national base of investors, to the exclusion of the government itself, allow rates that are effectively set at “zero” to remain? Something has to give but for now, and until the Yen breaks back through 140 the Dollar’s weakness will be disregarded.

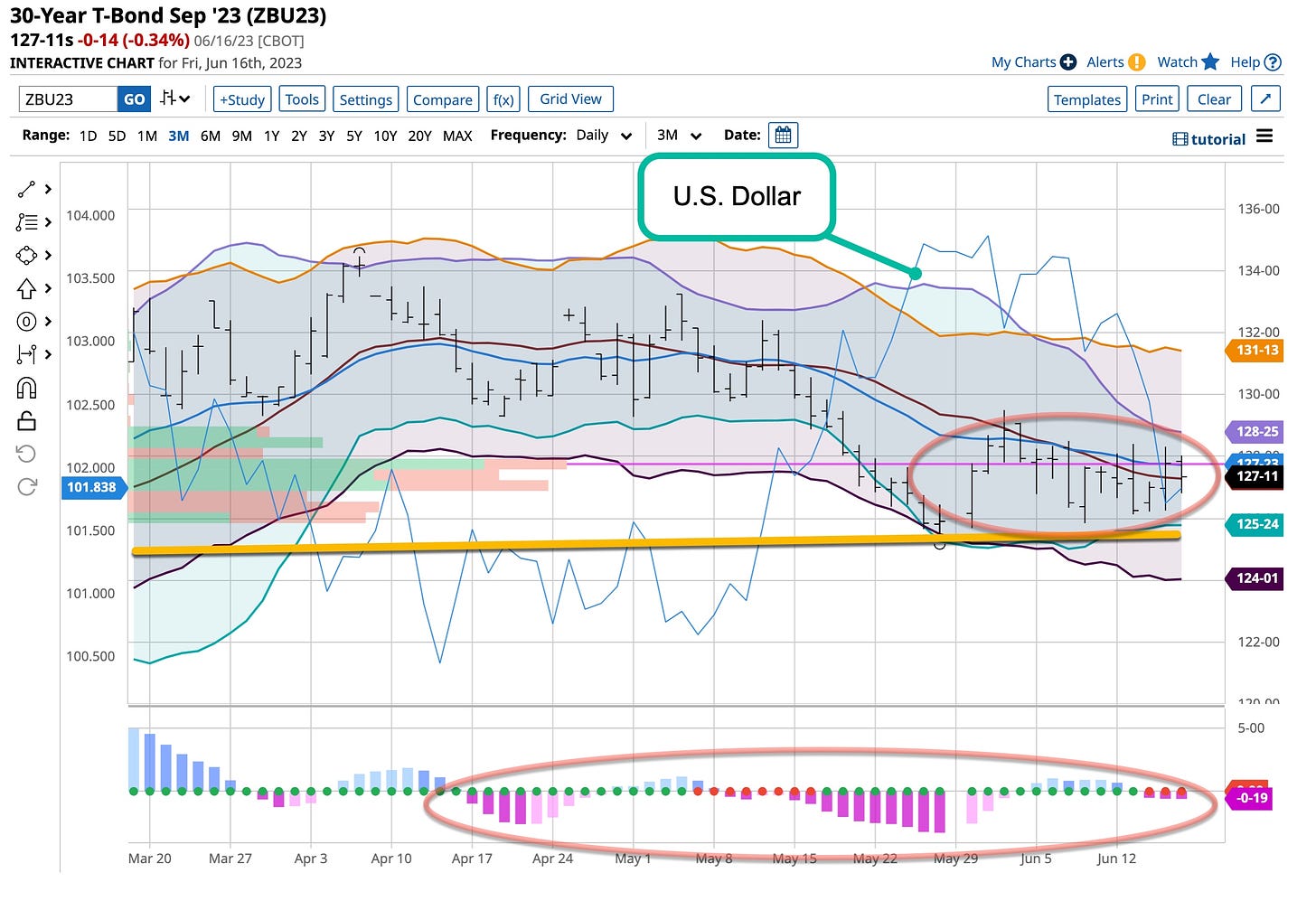

30-Year U.S. Treasury Bond

The granddaddy of the yield curve just can’t get out of its own way. It’s been basically directionless to the exception of a few blips to the downside but has not yet tested its lows around 117.50. For the U.S., for a yield curve to invert its going to need to do just that unless the rest of the shorter term instruments simply collapse in unison and that is unlikely.

Think about it, Powell took a break and the reactions in interest bearing instruments were more like a “yawn” than anything else. Are they preparing for something out of nowhere like the Chinese selling its U.S. debt holdings or at least a portion of them? If not with the Fed pausing, regardless of its future threat of tightening, yields should’ve come down but they didn’t. Keep your eyes on this one. China’s actions control where it’s heading going forward.

Now to some of my favorites, Corn and Soybeans. The world has to eat, right? These two commodities represent some of the largest sized commodities we export. When the Dollar declines the price of Corn and Soybeans increase, especially if the Dollar’s declining trend is expected to last.

When trading commodities of this nature you need to keep one eye on the Dollar and, in jest, the “other two” on the weather and crop reports. If you remember I suggested looking at a premier fertilizer stock Nutrien recently. There’s reasons for that past its P/E of less than 5 and dividend payout of close to 3.5%. If the U.S.manufactures any type of products it’s food. Add in the battle for Ukraine and “food” is a good place to be invested.

Enjoy your Saturday and join us for “The Week That Was & What’s Next”. Sorry it took two articles to get you ready for it but seldom does the opportunity arise to teach you in real time.

Remember, I’m just a “young” 68 years old and trust me, it was good to get a solid night of sleep, now out to the yard. Looking forward to the weekend’s U.S. Open and being able to teach you better how to be the best damn investor or trader you can possibly be.

Everyone learns at their own pace. If you pick everything up the first time through, great but if not email me at david@thetickeredu.com so we can further help. Again, let me know what you want to learn, I’m all ears.

Time to get a little gardening in before it hits 100 down here in Texas. The heat index is due to hit 120 tomorrow; maybe I’ll wear a T-shirt for the video. In any case here’s one from “The Fantasticks”. Back in time I played the part of El Gallo and despite his part being highlighted by some of the best songs ever written this was my favorite. So I’m off to “Plant A Radish”, how about you?