To the exclusion of the hundred-degree temperatures here in the “Lone Star State”, I love summers. People survive the heat but they cannot escape it. Air conditioning is essential and something to appreciate. So are past experiences. As much as history is just that, observing today’s sector shifts allows for events to repeat. For that reason, I will address an industry that’s been near and dear to my heart for forty-five years, the world of biotech.

Mom always wanted me to become a doctor just like every mother hopes for their son. On an educational basis, she was right. Between the sciences and math, I learned a lot about an industry that’s attracted me since the early days of monoclonal antibodies. I will always remember Celgene and how harmful reagents can be used to treat cancer.

These Two Are My Favorite Biotechs

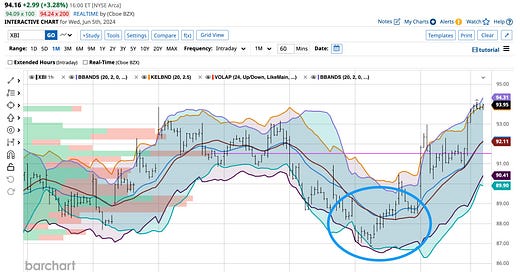

It’s a huge industry today. There are many analysts in the field today. They are smarter than me so I listen to them. That’s why you will always find a percentage point or two of what’s managed and invested in the SPDR S&P Biotech ETF of XBI. I practice what I preach and listen when someone can do something better than me. Besides biotechs in today’s world are vast and I cannot watch them all but the “XBI” can,

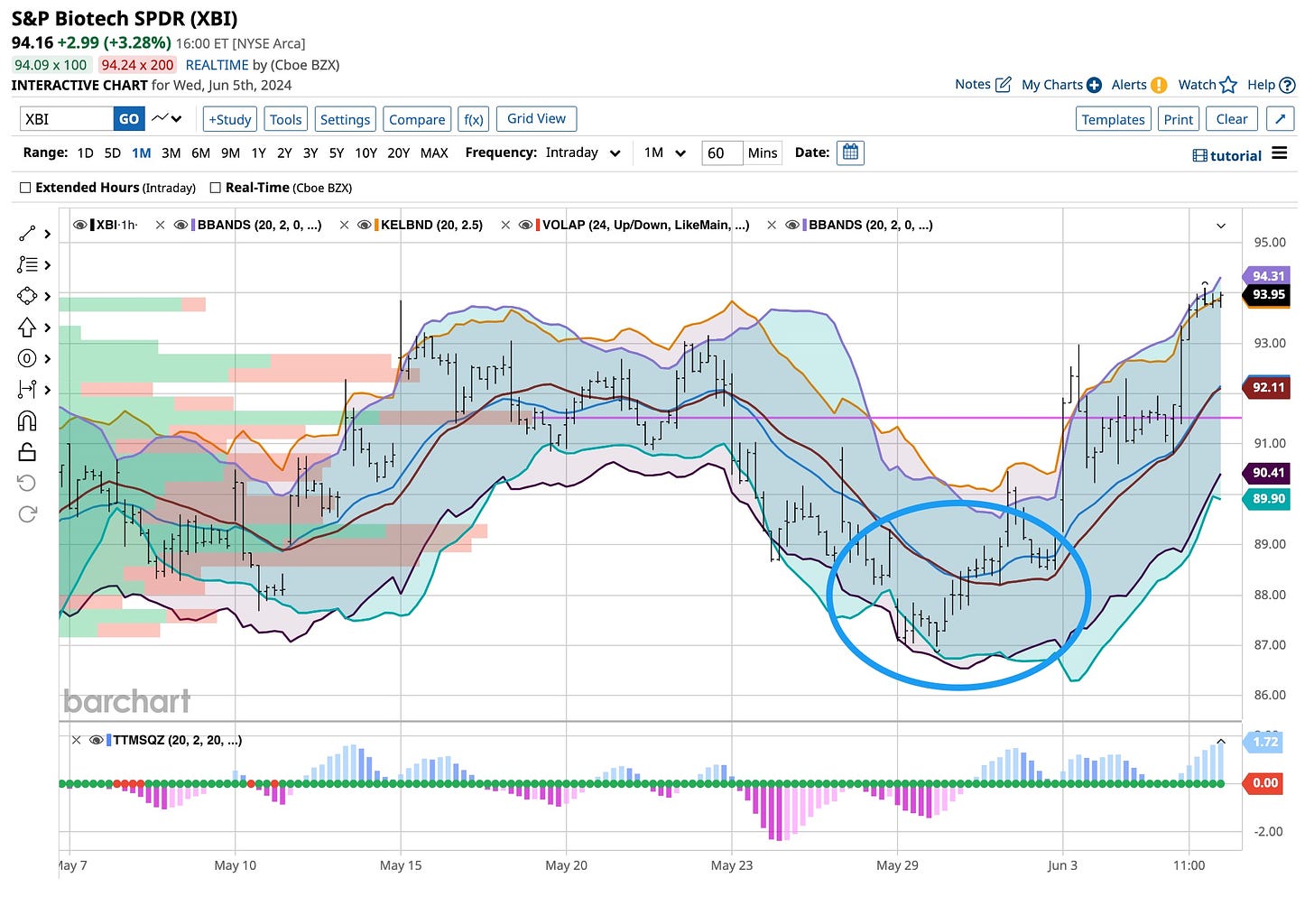

Amgen

Amgen Inc. (“AMGN”), is a leading American-based multinational biopharmaceutical company headquartered in Thousand Oaks, California. It is one of the world's largest biotechnology firms and focuses on developing innovative human therapeutics. It is known for Enbrel, Neulasta, and Prolia.

Amgen invests heavily in R&D to develop new therapies across various therapeutic areas, including oncology, cardiovascular disease, inflammation, bone health, and nephrology. The company is exploring advanced biotechnology platforms, such as bispecific T cell engagers (“BiTE”) and small interfering RNA (“siRNA”) therapies.

Amgen has consistently reported strong financial performance with robust revenue growth driven by its established products and new launches. It benefits from its cost management strategies, which have helped maintain healthy profit margins. Amgen's stock has been a solid performer, providing steady returns through price appreciation and dividends.

Amgen remains a dominant player in the biopharmaceutical industry with a strong track record of innovation, solid financial performance, and a focus on future growth areas such as biosimilars and novel therapeutics.

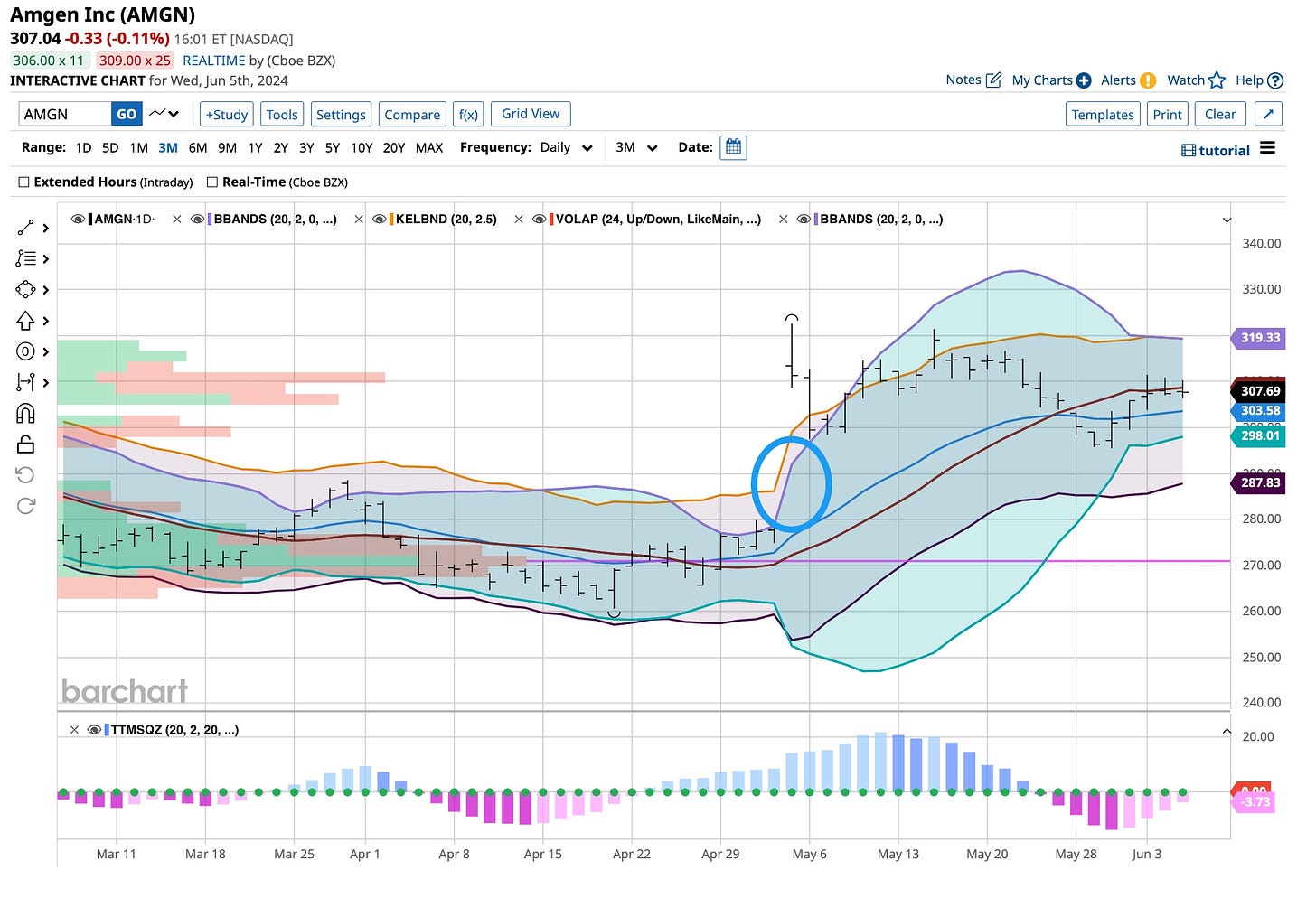

Regeneron Pharmaceuticals

Regeneron Pharmaceuticals, Inc. (“REGN”) is an American biotechnology company headquartered in Tarrytown, New York. Known for its innovative approach to drug discovery and development, Regeneron focuses on producing medicines for serious medical conditions. One of Regeneron’s flagship products, EYLEA, is used to treat various retinal diseases, including age-related macular degeneration (“AMD”) and diabetic retinopathy.

Dupixent is another major product, used for treating atopic dermatitis, asthma, and other inflammatory conditions. It has shown growth due to expanding indications and market penetration. Regeneron is known for its proprietary technologies, such as the VelociSuite® platform, VelocImmune®, and VelociGene®, enabling rapid and precise development of fully human antibodies. The company has a robust pipeline focused on oncology, immunology, and other therapeutic areas, with multiple candidates in various stages of clinical trials.

Regeneron has demonstrated strong financial performance. It’s been a very strong performer in the market reflecting the company’s growth trajectory and innovative product offerings.

Regeneron Pharmaceuticals offers a very strong emphasis on innovation and a robust pipeline of therapeutic candidates. Its “flagship” products drive significant revenue growth and market presence. Its commitment to research and development, strategic collaborations, and geographic expansion positions it well for future growth.

Another Favorite

Trade Desk

Trade Desk, Inc. (“TTD”), is a prominent player in today’s digital advertising industry, providing a technology platform for ad buyers to create, manage, and optimize digital advertising campaigns across various channels and formats.

The Trade Desk operates a demand-side platform that allows advertisers to purchase digital advertising inventory in real-time across various formats, display, video, audio, native, and social media. The platform leverages data and AI to enhance targeting and performance, providing advertisers with detailed insights and analytics to optimize their campaigns. Trade Desk’s platform supports omnichannel advertising, enabling brands to reach their audience across different devices and environments, like mobile, desktop, connected TV (“CTV”), and digital out-of-home (“DOOH”). It serves clients, including ad agencies, brands, and other enterprises maximizing their ROI through programmatic ad buying.

Trade Desk has experienced strong revenue growth, driven by the increasing shift of advertising budgets from “traditional” to digital media and the growing adoption of programmatic advertising. Its revenue model is primarily based on a percentage of the advertising spend managed through its platform.

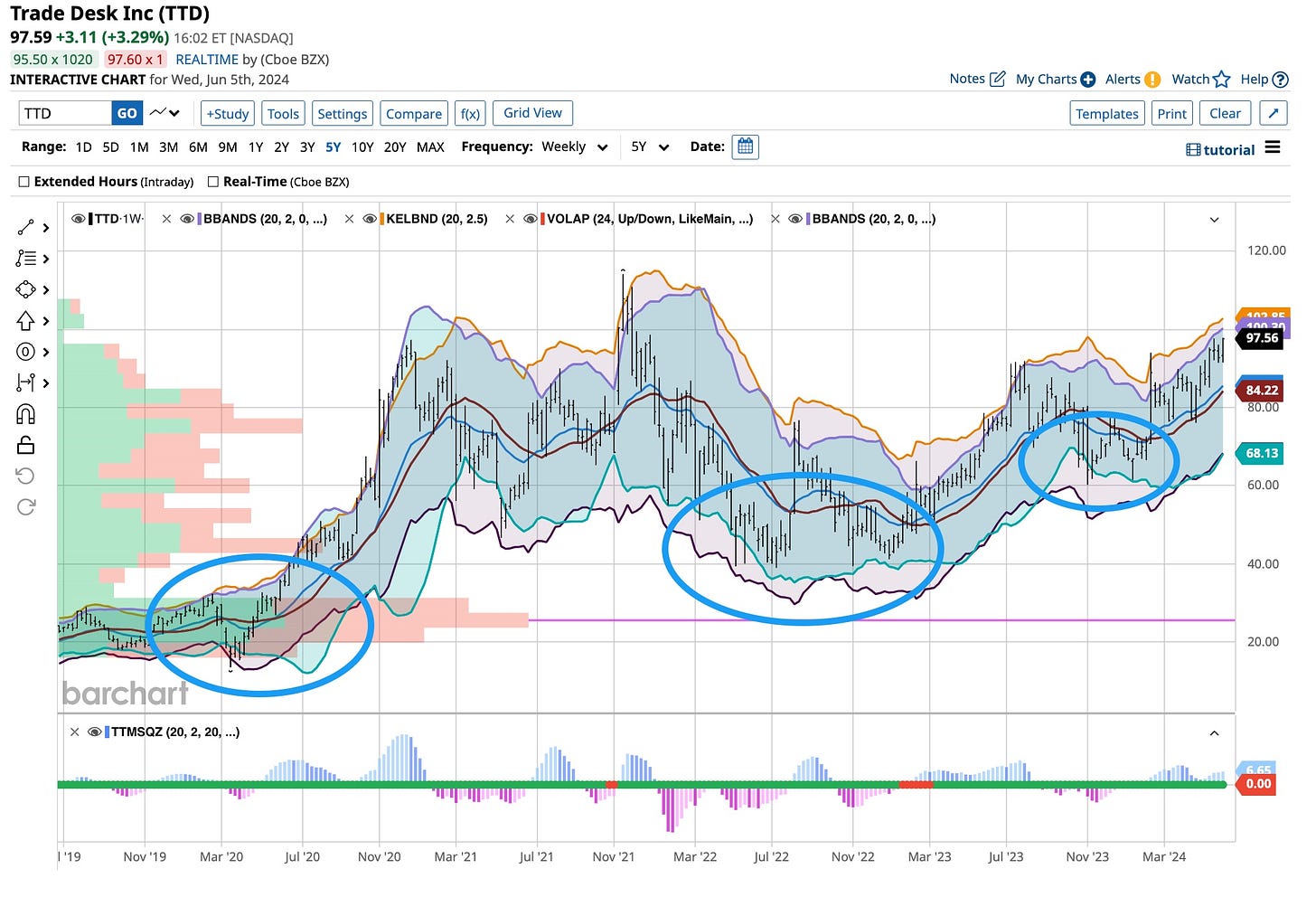

Trade Desk’s stock has been a high performer, reflecting investor confidence in the company’s growth prospects and the broader trend toward digital and programmatic advertising. The stock has shown significant volatility, influenced by broader market trends, quarterly earnings results, and industry developments.

The Trade Desk is a leading player in the programmatic advertising space, known for its advanced technology platform and strong growth trajectory. The company's focus on innovation, global expansion, and strategic partnerships positions capitalization on the ongoing shift to digital advertising.

What’s Happening At The Ticker

It’s always our intention to keep you abreast of what we hold in the portfolio. We will always “tell it like it is”. That benefits you and it shows both here and on our primary site The Ticker. We intend to let you know exactly what I’m thinking and the actions I’m taking “live” on The Ticker.

We’re sending direct email invitations to the tens of thousands of you who follow us here so keep your eyes open. With a limited introductory price of $99, you’ll receive our “real-time” communication and more. All told it’s a $1,000 value so join us and as always, thank you for your interest.

From the start, our interest has been centered around taking the experience existing “between our ears” and putting it between yours. It’s a learning process for you and us as well. It’s hard to believe the sheer number of followers we’ve attracted. We always say thanks and we always listen. Everybody wants to know “what’s next” as far as it comes to investing and trading. To a degree, we’ll oblige but we find it is much more important that you learn the “right way”. A strong “foundation” is our goal and that’s what we’re offering with our courses. Following with the “bricks & mortar” ties it all together. Join us by clicking on our invitation, welcome aboard and thanks always.